AS CONFIDENTIALLY SUBMITTED TO THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 10th, 2022 THIS DRAFT REGISTRATION STATEMENT HAS NOT BEEN PUBLICLY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AND ALL INFORMATION HEREIN REMAINS CONFIDENTIAL

Registration No. 333-_____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BULLFROG AI HOLDINGS, INC.

(Exact Name of Registrant as specified in its charter)

| Nevada | 84-4786155 | |||

(State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

323 Ellington Blvd, Unit 317

Gaithersburg, MD 20878

Tel. (240) 658-6710

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vininder Singh

Chief Executive Officer

Bullfrog AI Holdings, Inc.

325 Ellington Blvd., Unit 317

Gaithersburg, MD 20878

Tel: (240) 658-6710

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Arthur S. Marcus, Esq. | Ross David Carmel, Esq. |

| Matthew Siracusa, Esq. | Jeffrey P. Wolford, Esq. |

Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 31 Fl. New York, NY 10036 |

Carmel, Milazzo & Feil LLP 55 West 39th Street New York, NY 10018 |

| Telephone: (212) 930-9700 | Telephone: (212) 658-0458 |

| Facsimile: (212) 930-9725 | Facsimile: (646) 838-1314 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large Accelerated Filer ☐ | Accelerated Filer ☐ |

| Non-Accelerated Filer ☒ | Smaller Reporting Company ☒ |

| Emerging Growth Company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two forms of prospectuses: one to be used in connection with the initial public offering of up to shares of common stock through the underwriters named on the cover page of this prospectus (the “IPO Prospectus”) and one to be used in connection with the potential resale by a selling stockholders of up to common stock (the “Resale Prospectus”). The IPO Prospectus and the Resale Prospectus will be identical in all respects except for the alternate pages for the Resale included herein which are labeled “Alternate Pages for Resale Prospectus.”

The Resale Prospectus is substantively identical to the IPO Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers; | |

| ● | they contain different Offering sections in the Prospectus Summary section; | |

| ● | they contain different Use of Proceeds sections; | |

| ● | the Capitalization section is deleted from the Resale Prospectus; | |

| ● | the Dilution section is deleted from the Resale Prospectus; | |

| ● | A Selling Stockholder section is included in the Resale Prospectus; | |

| ● | the Underwriting section from the IPO Prospectus is deleted from the Resale a Plan of Distribution is inserted in its place; and | |

| ● | the Legal Matters section in the Resale Prospectus deletes the reference to counsel for the underwriters. |

We have included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the IPO Prospectus.

While the selling stockholders have expressed an intent not to sell the common stock registered pursuant to the Resale Prospectus prior to the closing of or concurrently with the public offering, the sales of our common stock registered in the IPO Prospectus and the Resale Prospectus may result in two offerings taking place sequentially or concurrently, which could affect the price and liquidity of, and demand for, our common stock. This risk and other risks are included in “Risk Factors” beginning on page 8 of the IPO Prospectus.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED ______, 2022 |

Shares of

Common Stock

BULLFROG AI HOLDINGS, Inc.

This is a firm commitment initial public offering of shares of common stock of Bullfrog AI Holdings, Inc. (the “Company”, “we”, “us”, “our”). No public market currently exists for our shares. We anticipate that the initial public offering price of our shares will be $ per share.

We intend to apply to list our shares of common stock for trading on the Nasdaq Capital Market, subject to official notice of issuance, under the symbol “BULL.” No assurance can be given that our application will be approved. The consummation of this offering is conditioned on obtaining Nasdaq approval.

Upon the completion of this offering, Mr. Vininder Singh, our Chief Executive Officer and a director, will beneficially own approximately [*]% of the Company’s common stock (approximately [*]% if the over-allotment option is exercised) and we will be a “controlled company” within the meaning of the listing rules of The Nasdaq Stock Market LLC.

We are an emerging growth company under the Jumpstart our Business Startups Act of 2012, or JOBS Act, and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Investing in our common stock involves a high degree of risk.

The registration statement of which this prospectus forms a part also relates to the registration for resale of an aggregate of [ ] shares of common stock issuable upon the conversion of certain promissory notes and the exercise of certain warrants.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to Bullfrog AI Holdings, Inc. (before expenses) | $ | $ | ||||||

| (1) | See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted the underwriters an option, exercisable within 45-days after the closing of this offering to acquire up to an additional 15% of the total number of securities sold in this offering, and each of the components thereof, separately or on one or more occasion, solely for the purpose of cover over-allotments.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2022.

WALLACHBETH CAPITAL LLC

The date of this prospectus is , 2022

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

For investors outside the United States: Neither we nor the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

| i |

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth under the sections “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto, in each case included in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.” Except as otherwise indicated, references to “we”, “us”, “our”, and the “Company” refer to Bullfrog AI Holdings, Inc. and its wholly-owned subsidiaries.

Business Overview

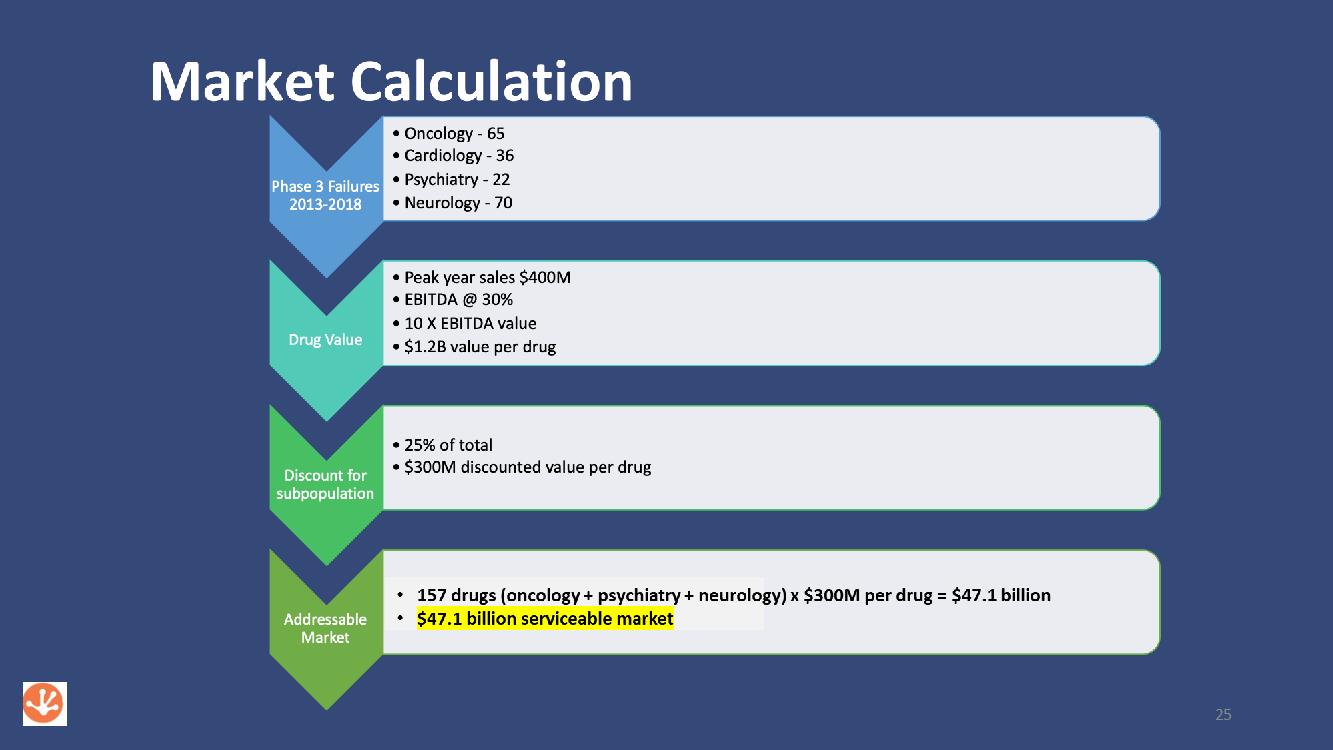

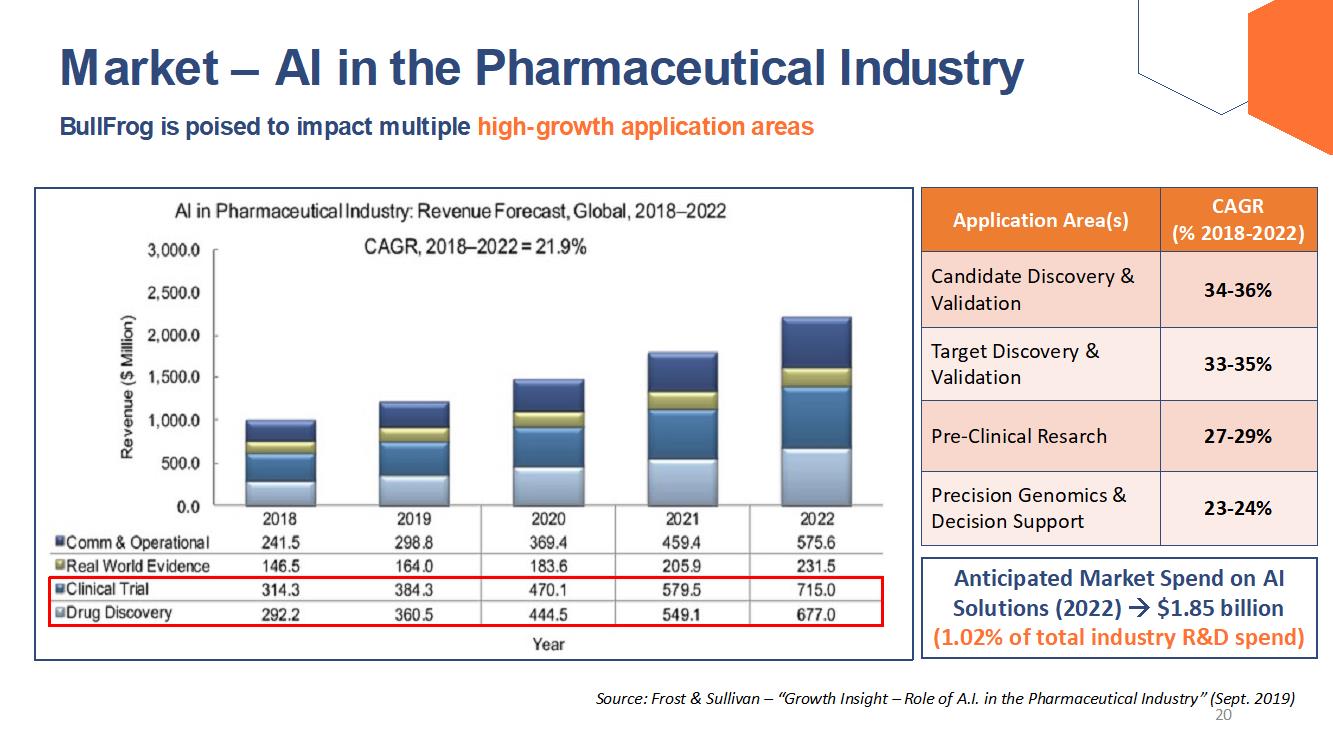

Most new therapeutics will fail at some point in preclinical or clinical development. This is the primary driver of the high cost of developing new therapeutics. A major part of the difficulty in developing new therapeutics is efficient integration of complex and highly dimensional data generated at each stage of development to de-risk subsequent stages of the development process. Artificial Intelligence and Machine Learning (AI/ML) has emerged as a digital solution to help address this problem.

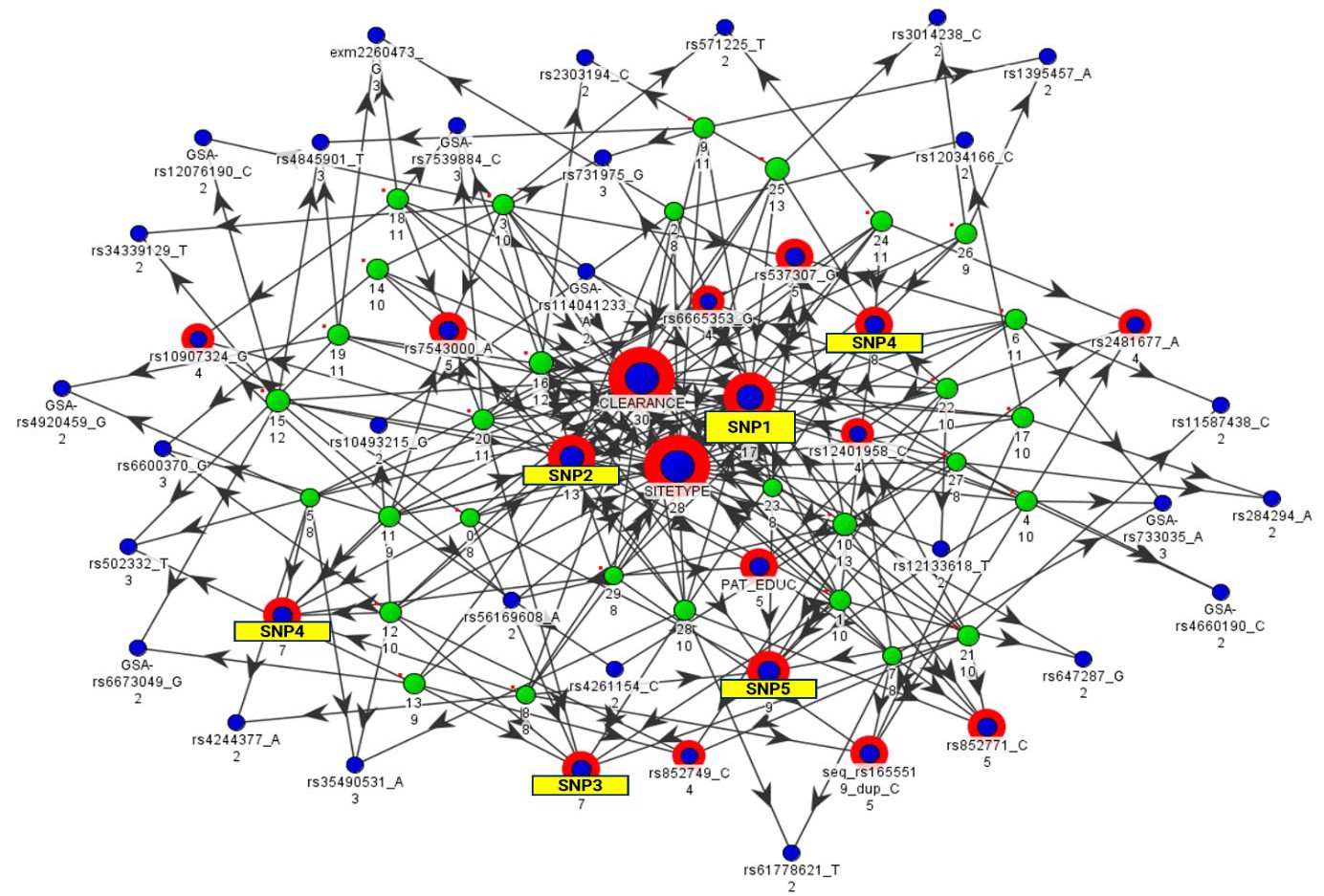

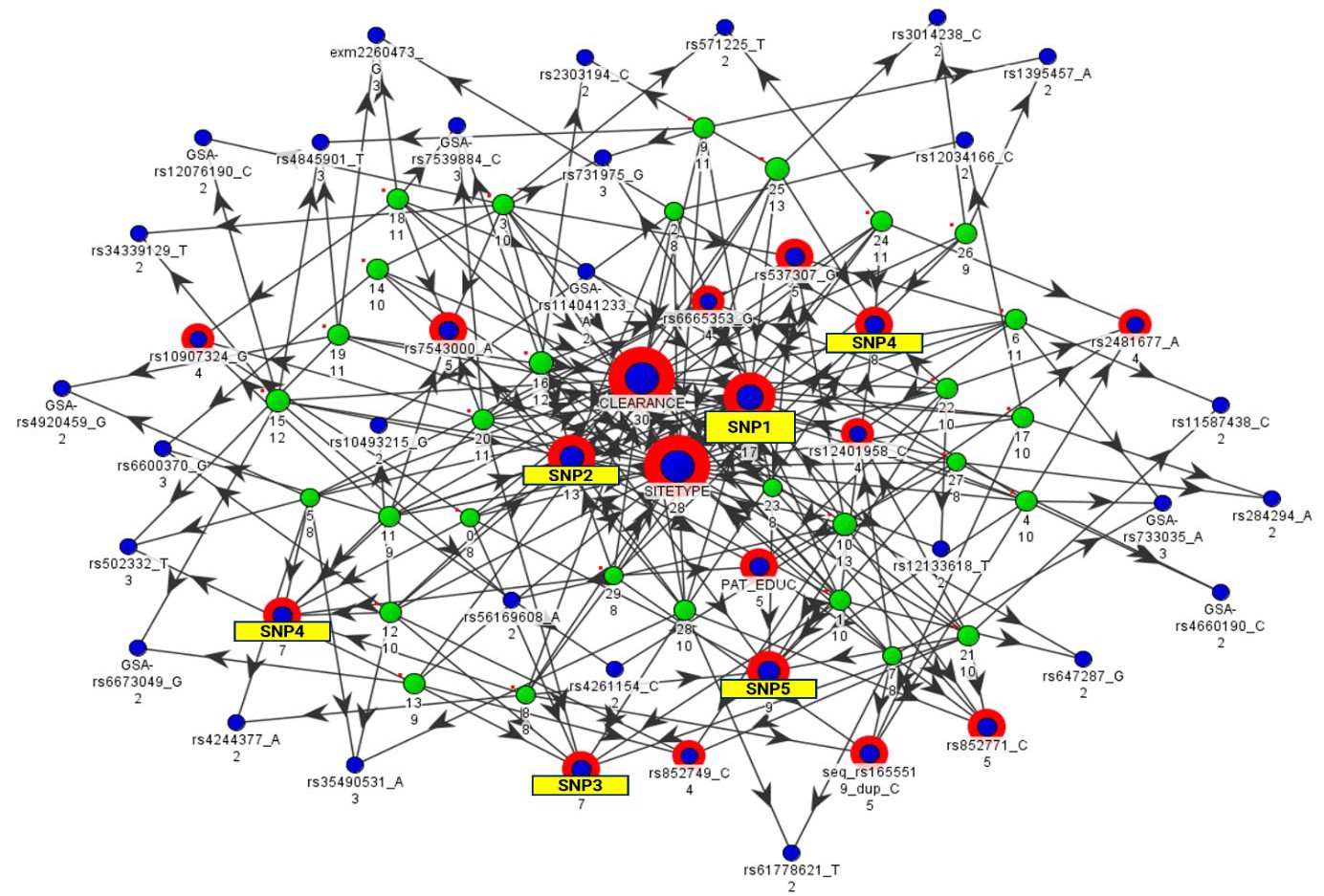

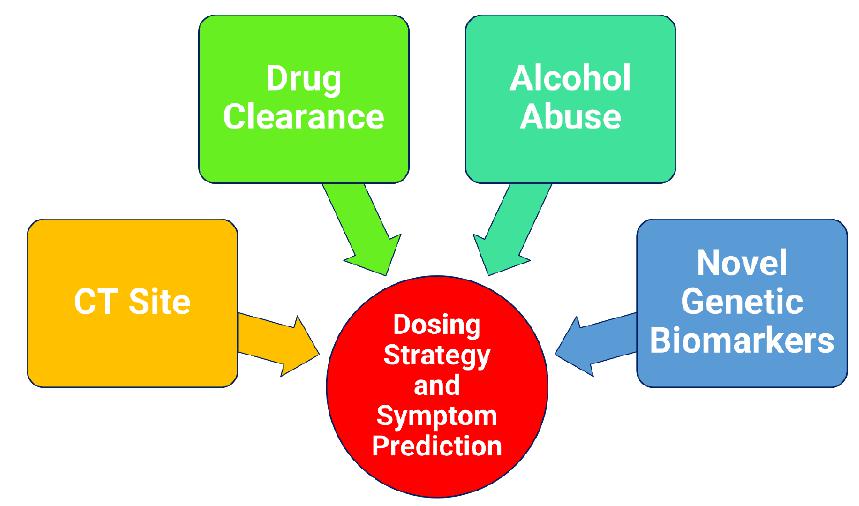

We are an artificial intelligence-driven biotechnology company committed to increasing the probability of success and decreasing the time and cost involved in developing therapeutics. Most current AI/ML platforms still fall short in their ability to synthesize disparate, high-dimensional data for actionable insight. Our platform technology, named, bfLEAP™ is an analytical AI/ML platform derived from technology developed at The Johns Hopkins University Applied Physics Laboratory (JHU-APL), which is able to surmount the challenges of scalability and flexibility currently hindering researchers and clinicians by providing a more precise, multi-dimensional understanding of their data. We are deploying bfLEAP™ for use at several critical stages of development for internal programs and through strategic partnerships and collaborations with the intention of streamlining data analytics in therapeutics development, decreasing the overall development costs by decreasing failure rates for new therapeutics, and impacting the lives of countless patients that may otherwise not receive the therapies they need.

The bfLEAP™ platform utilizes both supervised and unsupervised machine learning – as such, it is able to reveal real/meaningful connections in the data without the need for a prior hypothesis. Algorithms used in the bfLEAP™ platform are designed to handle highly imbalanced data sets to successfully identify combinations of factors that are associated with outcomes of interest.

Our primary goal is to improve the odds of success at any stage of pre-clinical and clinical therapeutics development, for in house programs, and our strategic partners and collaborators. Our primary business model is improving the success and efficiency of drug development which is accomplished either through acquisition of drugs or partnerships and collaborations with companies that are developing drugs. We hope to accomplish this through strategic acquisitions of current clinical stage and failed drugs for in-house development, or through strategic partnerships with biopharmaceutical industry companies. We are able to pursue our drug asset enhancement business by leveraging a powerful and proven AI/ML platform (trade name: bfLEAP™) initially derived from technology developed at JHU-APL. We believe the bfLEAP™ analytics platform is a potentially disruptive tool for analysis of pre-clinical and/or clinical data sets, such as the robust pre-clinical and clinical trial data sets being generated in translational R&D and clinical trial settings. In November 2021 , we amended the agreement with JHU-APL to include additional advanced AI technology.

We believe bfLEAP™ will inform/enable decision making throughout the development cycle:

● 1. Discovery Phase – Analyze and categorize discovery phase data to better define highest-value leads from groups of candidates, for advancement to preclinical phase of development. Integrate data from high-throughput screening, pharmacodynamics assays, pharmacokinetics assays, and other key data sets to create the most accurate profile of a pool of therapeutic candidates. There is often a high degree of similarity among closely related therapeutics in a candidate pool – bfLEAP™ is able to harmonize disparate data streams for a more nuanced understanding of each candidate’s characteristics/potency.

● 2. Pre-Clinical Data - Large-scale/multivariate analysis of pre-clinical and/or early-stage clinical data sets. In these settings, bfLEAP could be used to find novel drug targets, elucidate mechanism of action (MOA), predict potential off-target effects/side effects, uncover specific genetic/phenotypic background(s) with highest correlation to therapeutic response, etc. These insights from bfLEAP™ analysis can be used to mitigate risk and inform decision making/study design at the subsequent step(s) of therapeutic/diagnostic development, including first-inhuman/Phase I RCTs.

| 1 |

● 3. Clinical Development - Advanced/multivariate analysis of PhI and/or PhII clinical trials data, to find niche populations of highly responsive patients and/or inform patient selection for later-stage CT(s). This can be used to decrease overall study risk and increase the odds-of-success for larger clinical trials - including Phase II trials, and any Phase III Registration Clinical Trials. The bfLEAP™ platform analysis can also be used to more precisely understand complex correlations between therapeutic treatment and adverse events, side effects, and other undesirable responses which could jeopardize clinical trial success.

Our platform is agnostic to the disease indication or treatment modality and therefore we believe that it is of value in the development of biologics or small molecules.

The process for our drug asset enhancement program is to:

| ● | acquire the rights to a drug from a biopharmaceutical industry company or academia; | |

| ● | use the proprietary bfLEAP™ AI/ML platform to determine a multi-factorial profile for a patient that would best respond to the drug; | |

| ● | Rapidly conduct a clinical trial to validate the drug’s use for the defined “high-responder” population; and | |

| ● | Divest/sell the rescued drug asset with the new information back to a large player in the pharma industry, following positive results of the clinical trial. |

As part of our strategy, we will continue evolving our intellectual property, analytical platform and technologies, build a large portfolio of drug candidates, and implement a model that reduces risk and increases the frequency of cash flow from rescued drugs. This strategy will include strategic partnerships, collaborations, and relationships along the entire drug development value chain, as well as acquisitions of the rights to developing failed drugs and possibly the underlying companies.

We are preparing to ramp up our businesses using funds from this offering and through our partnerships and relationships. We currently have a strategic relationship with a leading rare disease non-profit organization for AI/ML analysis of late stage clinical data. We have also positioned the Company to acquire the rights to a series of preclinical and early clinical drug assets from universities, as well as a strategic collaboration with a world renowned research institution to create a HSV1 viral therapeutic platform to engineer immunotherapies for a variety of diseases. In addition, we have signed exclusive world-wide license agreements with Johns Hopkins University for a cancer drug that targets glioblastoma (brain cancer), pancreatic cancer, and other cancers. We have also signed an exclusive worldwide license with George Washington University for another cancer drug that targets hepatoceullar carcinoma (liver cancer), and other liver diseases.

We intend to generate revenue from the following three sources:

Contract Services

Our fee for service partnership offering model is designed for biopharmaceutical companies, as well as other organizations, of all sizes that have challenges analyzing data throughout the drug development process. We provide the customer with an analysis of large complex data sets using our proprietary Artificial Intelligence / Machine Learning platform called bfLEAP™. This platform is designed to predict targets of interest, patterns, relationships, and anomalies. Our service model involves a cash fee plus the potential for rights to new intellectual property generated from the analysis, which can be performed at the discovery, preclinical, or clinical stages of drug development.

Collaborative Arrangements

We plan to enter into collaborative arrangements with biotechnology and pharmaceutical companies who have drugs that are in development or have failed late Phase 2 or Phase 3 trials. The collaborations may also be at the discovery or preclinical stages of drug development. Our revenue will be a combination of fee for service cash payments and success fees based on achieving certain milestones as determined by each specific arrangement. There may also be fees or legal rights associated with the development of new intellectual property.

| 2 |

Acquisition of Rights to Certain Drugs

We may acquire the rights to drugs that have failed late Phase 2 or Phase 3 trials and generate revenues by using our platform to accurately determine the profile of patients that would respond to the drugs, conduct a clinical trial to test our findings either independently or with a clinical partner, and finally sell the drug back to pharmaceutical companies. We have and may continue acquiring the rights to drugs that have not yet failed any trials. We will use our technology to improve the chances for success, conduct a trial, and divest the asset. When divesting assets, the transaction may involve a combination of upfront payments, milestone payments based on clinical success, and royalties on sales of the product.

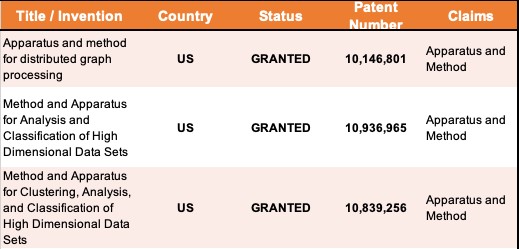

Our bfLEAP™ Analytics Platform

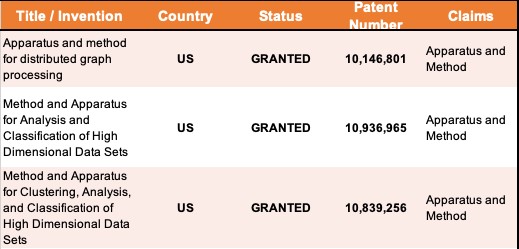

We are able to pursue our drug rescue business by leveraging a powerful and proven AI/ML platform (trade name: bfLEAP™) derived from technology developed at The Johns Hopkins University Applied Physics Laboratory (JHU-APL). The bfLEAP™ platform is based on an exclusive, world-wide license granted by Johns Hopkins University Applied Physics Laboratory. The license covers three (3) issued patents, as well as a new provisional patent application, non-patent rights to proprietary libraries of algorithms and other trade secrets, which also includes modifications and improvements.

We believe the bfLEAP™ analytics platform is a potentially disruptive tool for analysis of pre-clinical and/or clinical data sets, such as the robust pre-clinical and clinical trial data sets being generated in translational R&D and clinical trial settings. The input data for bfLEAP™ can include raw data (preclinical and/or clinical readouts), categorical data, sociodemographic data of patients, and various other inputs. Thus, the bfLEAP™ platform is capable of capturing the particular genetic and physical characteristics of patients in an unbiased manner, and contextualizing it against other disparate data sources from patients (e.g. molecular data, physiological data, etc.) for less biased and more meaningful conclusions. It is also uniquely scalable – the bfLEAP™ platform is able to perform analysis on large, high-volume data sets (i.e. ‘big data’) and also able to analyze highly disparate “short and wide” data as well. In terms of visualization, bfLEAP™ is able to integrate with most commonly used visualization tools for graph analytics.

We believe that the combination of a) scalable analytics (i.e., large data or short/wide data), b) state-of-the-art proprietary algorithms, c) unsupervised machine learning, and d) streamlined data ingestion/visualization makes bfLEAP™ one of the most flexible and powerful new platforms available on the market.

The Company will continue to evolve and improve bfLEAP™, and some of the proceeds from this offering may be used toward that effort either in-house or with development partners like The Johns Hopkins University Applied Physics Lab.

Summary Risk Factors

Our business is subject to numerous risks as described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

| ● | We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters. | |

| ● | In order for the Company to compete and grow, it must attract, recruit, retain and develop the necessary personnel who have the needed experience. | |

| ● | The development and commercialization of our technology, products, and services is highly competitive. | |

| ● | The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees. | |

| ● | We rely on various intellectual property rights, including patents and licenses in order to operate our business. | |

| ● | From time to time, third parties may claim that one or more of our products or services infringe their intellectual property rights. | |

| ● | New product development involves a lengthy, expensive and complex process. | |

| ● | We may not be able to conduct clinical trials necessary to commercialize and sell our proposed products and formulations. | |

| ● | Our long-term viability and growth will depend upon successful clinical trials. | |

| ● | We face significant competition from other biotechnology and pharmaceutical companies. | |

| ● | Our research and development efforts may not succeed in developing commercially successful products and technologies, which may limit our ability to achieve profitability. | |

| ● | Even if we are able to obtain regulatory approvals for new pharmaceutical products, generic or branded, the success of those products is dependent upon acceptance of such products, particularly by the pharmaceutical industry. |

| 3 |

| ● | We extensively outsource our clinical trial activities and usually perform only a small portion of the start-up activities in-house. | |

| ● | We may not be able to acquire the rights to any failed drugs or we may not be able to rescue failed drugs through analysis due to our technology or the lack of clinical data. |

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last completed fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include:

| ● | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; | |

| ● | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements; | |

| ● | extended transition periods for complying with new or revised accounting standards; | |

| ● | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, in addition to any required unaudited interim financial statements in this prospectus; and | |

| ● | reduced disclosures regarding executive compensation in our periodic reports, proxy statements and registration statements, including in this prospectus. |

We will remain an emerging growth company until the earliest to occur of: (i) the end of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (ii) the end of the first fiscal year in which we are deemed to be a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, as amended, (the “Exchange Act”); (iii) the date on which we have, during the previous three-year period, issued more than $1.00 billion in non-convertible debt securities; and (iv) the end of the fiscal year during which the fifth anniversary of this offering occurs. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We currently intend to take advantage of the exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We are also a “smaller reporting company,” as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemed a smaller reporting company until our public float exceeds $75 million on the last day of our second fiscal quarter in the preceding fiscal year.

Controlled Company

Upon the completion of this offering, Mr. Vininder Singh, our Chief Executive Officer and a director will beneficially own approximately [*]% of the Company’s common stock (approximately [*]% if the over-allotment option is exercised) and we will be a “controlled company” within the meaning of the listing rules of The Nasdaq Stock Market LLC.

As long as our officers and directors, either individually or in the aggregate, own at least 50% of the voting power of our Company, we are a “controlled company” as defined under Nasdaq Marketplace Rules.

| 4 |

For so as we are a controlled company under that definition, we are permitted to rely on certain exemptions from corporate governance rules, including:

● an exemption from the rule that a majority of our board of directors must be independent directors;

● an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and

● an exemption from the rule that our director nominees must be selected or recommended solely by independent directors.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elect to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors.

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Recent Developments

The Company recently entered into the following licensing agreements:

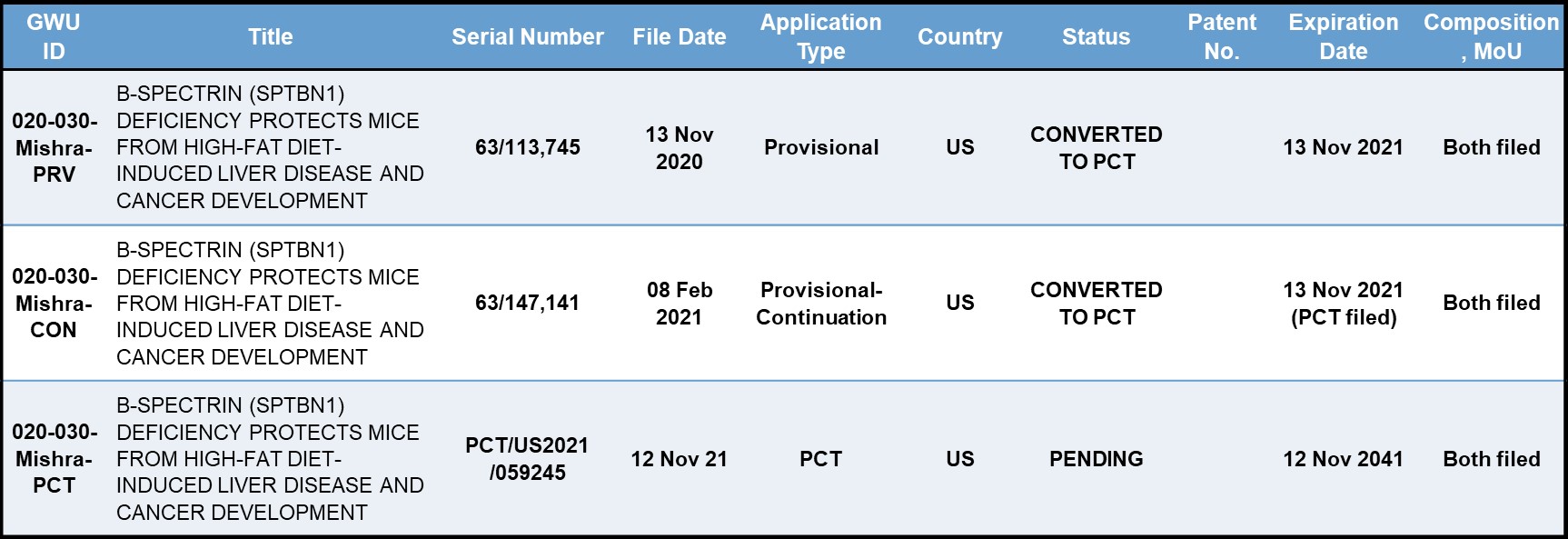

George Washington University - Beta2-spectrin siRNA License

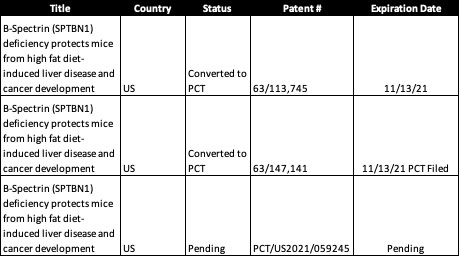

On January 14, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from George Washington University (GWU) for rights to use siRNA targeting Beta2-spectrin in the treatment of human diseases, including hepatocellular carcinoma (HCC). The license covers methods claimed in three US and worldwide patent applications, and also includes use of this approach for treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis.

In consideration of the rights granted to the Company under the License Agreement GWU received a $20,000 License Initiation Fee. Under the terms of the License Agreement, GWU will be entitled to a three percent (3%) royalty on net sales subject to quarterly minimums once the first sale has occurred subsequent to regulatory approval, as well sublicense or assignment fees in the event the Company sublicenses or assigns their rights to use the technology. The Company will also reimburse GWU for previously incurred and ongoing patent costs. The Sublicense and Assignment fee amounts decline as the Company advances the clinical development of the licensed technology. The license agreement also contains milestone payments for clinical development through the approval of an NDA and commercialization.

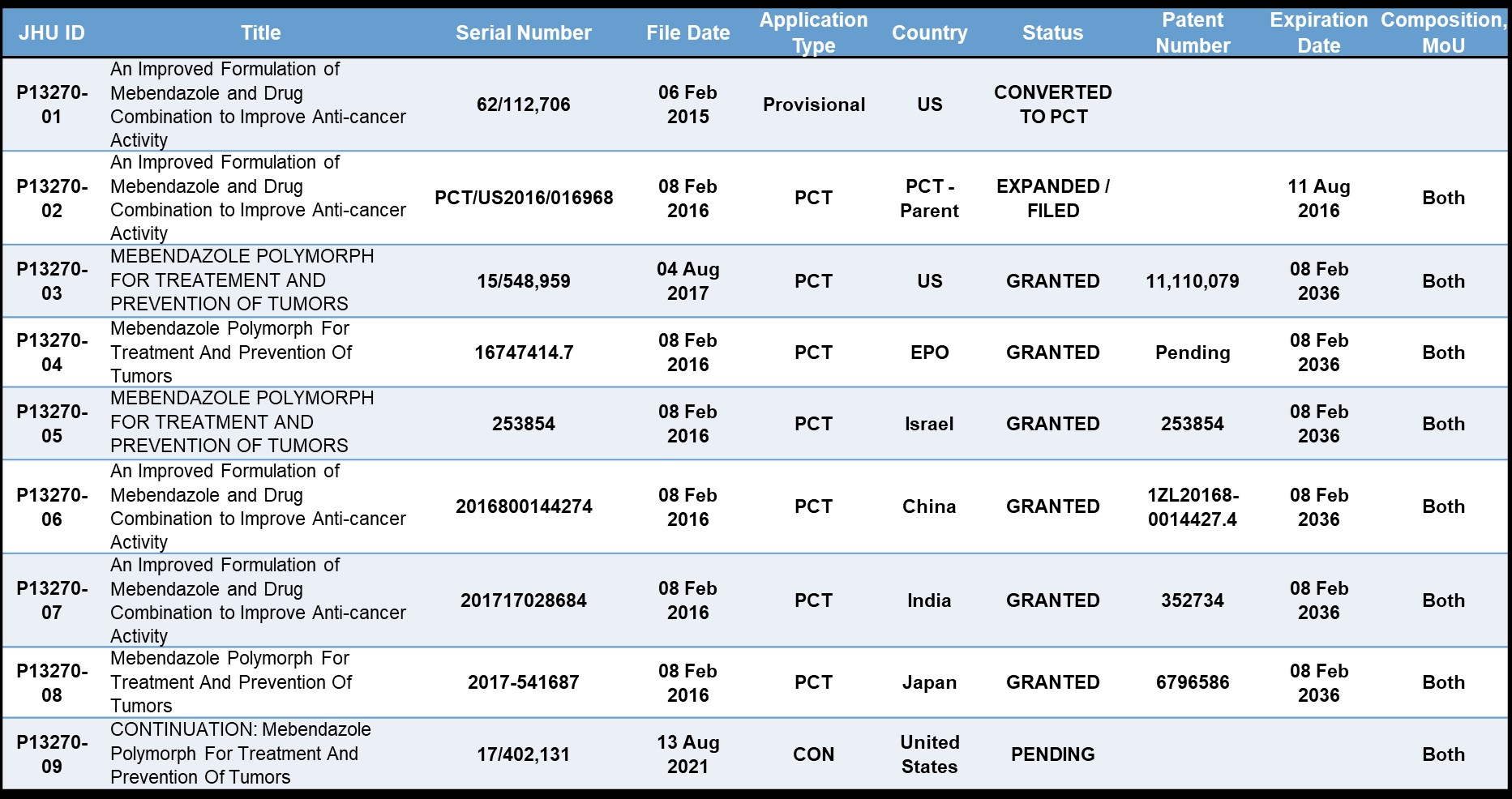

Johns Hopkins University – Mebendazole License

On February 22, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from Johns Hopkins University (JHU) for the use of an improved formulation of Mebendazole for the treatment of any human cancer or neoplastic disease. This formulation shows potent activity in animal models of different types of cancer, and has been evaluated in a Phase I clinical trial in patients with high-grade glioma (NCT01729260). The trial, an open-label dose-escalation study, enrolled 24 patients and demonstrated long-term safety and acceptable toxicity of the drug with adjuvant temozolamide in this population.

The license covers six (6) issued patents and one (1) pending application. In consideration of the rights granted to the Company under the License Agreement JHU will receive a staggered Upfront License Fee of $250,000. The Company will also reimburse JHU for previously incurred and ongoing patent costs. Under the terms of the License Agreement, JHU will be entitled to three- and one-half percent (3.5%) royalty on net sales by the Company. In addition, the Company is required to pay JHU minimum annual royalty payments of $5,000 for 2023, $10,000 for 2024, $20,000 for 2025, $30,000 for 2026 and $50,000 for 2027 and each year after until the first commercial sale after which the annual minimum royalty shall be $250,000. The license agreement also contains milestone payments for clinical development steps through the approval of an NDA and commercialization

| 5 |

Corporate Information

Bullfrog AI Holdings, Inc. was incorporated in the State of Nevada on February 6, 2020. . Bullfrog AI Holdings, Inc. is the parent company of Bullfrog AI, Inc. and Bullfrog AI Management, LLC. which were incorporated in Delaware and Maryland, in 2017 and 2021, respectively. All of our operations are currently conducted through BullFrog AI Holdings, Inc.. The Company’s principal business address is 325 Ellington Blvd, Unit 317,Gaithersburg, MD 20878. Our website address is www.bullfrogai.com. The references to our website in this prospectus are inactive textual references only. The information on our website is neither incorporated by reference into this prospectus nor intended to be used in connection with this offering. All of our operations are currently conducted through BullFrog AI, Inc.

Going Concern

The Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of expanding its revenues and additional equity and debt financing. The Company anticipates raising additional funds through public or private financing, strategic relationships or other arrangements in the near future to support its business operations; however, the Company may not have commitments from third parties for a sufficient amount of additional capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and its failure to raise capital when needed could limit its ability to continue its operations. The Company’s ability to obtain additional funding will determine its ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on the Company’s financial performance, results of operations and stock price and may require it to curtail or cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of the Company’s common stock, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require that the Company relinquish valuable rights. Please see note 1, in our financial statements, for further information. The Company believes that, following this offering, it will have sufficient capital to sustain its operations for at least the next 24 months, however, there can be no assurance that sufficient funds required during the subsequent year or thereafter will be generated from operations or that funds will be available from external sources such as debt or equity financings or other potential sources.

The following summary of the offering contains basic information about the offering and the common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the common stock, please refer to the section of this prospectus entitled “Description of Capital Stock.”

| Common Stock offered by us | shares | |

| Common Stock outstanding before this offering: | shares | |

| Common Stock to be outstanding immediately after this offering: | shares(1) | |

| Offering Price | $ per share | |

| Option to purchase additional shares: | We have granted the underwriters an option, exercisable within 45 days after the closing of the offering to acquire up to an additional 15% of the total number of securities to be sold in this offering, and each of the components thereof, separately on one or more occasion, solely for the purpose of covering over-allotments. |

| 6 |

| Use of proceeds: | We expect to receive approximately $ in net proceeds from the sale of our shares offered by us in this offering (approximately $ if the underwriters exercise their over-allotment option in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to [*].

See “Use of Proceeds” on page 23 for a more complete description of the intended use of proceeds from this offering. | |

| Dividend Policy | Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors. | |

| Risk Factors: | Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 8 of this prospectus before deciding whether or not to invest in our common stock. | |

| Proposed Nasdaq Ticker Symbol | We intend to apply to list our common stock on the Nasdaq Capital Market, subject to official notice of issuance, under the symbol “BULL” | |

| Lock-ups | We and our directors, officers and holders of five percent (5%) or more of our outstanding securities have agreed with the underwriters, subject to certain exceptions, not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock for a period of 12 months after the completion of this offering. See “Underwriting” on page 56.] |

| (1) | Based on [ ] shares of common stock issued and outstanding as of [ ], 2022. |

Unless otherwise indicated, the information in this prospectus assumes:

| ☐ | A public offering price of $____ per share of common stock; | |

| ☐ | No exercise by the underwriter of its option to purchase additional shares of common stock to cover over-allotments, if any; | |

| ☐ | No exercise of the underwriter’s warrants; | |

| ☐ | _____shares of common stock sold in this offering; and | |

| ☐ | Outstanding warrants to purchase [ ] shares of common stock at $[ ] per share which expire on [ ]. |

SUMMARY SELECTED FINANCIAL DATA

The summary selected financial data set forth below should be read together with our financial statements and the related notes to those statements, as well as the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. The statements of operations data for the period ended December 31, 2021 has been derived from our audited financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future, and the results for the year ended December 31, 2021 are not necessarily indicative of results to be expected for the full year ending December 31, 2022.

| Statements of Operations Data | ||||||||

| For the year ended | For the year ended | |||||||

| December 31, 2021 | December 31, 2020 | |||||||

| Revenues | $ | - | $ | - | ||||

| Net income (loss) | $ | (585,840 | ) | $ | (341,690 | ) | ||

| Net income (loss) per share | $ | (0.02 | ) | $ | (0.01 | ) | ||

| Weighted average number of shares | 26,145,503 | 24,803,210 | ||||||

| Balance Sheet Data | ||||||||

| As of | Pro Forma as Adjusted for | |||||||

| December 31, 2021 | December 31, 2021 | |||||||

| Cash | $ | 10,014 | $ | 5,019 | ||||

| Total assets | $ | 10,014 | $ | 5,019 | ||||

| Total liabilities | $ | 1,019,121 | $ | 545,537 | ||||

| Total stockholder’s equity (deficit) | $ | (1,009,107 | ) | $ | (540,518 | ) | ||

| 7 |

An investment in our common stock is highly speculative and involves a high degree of risk. In determining whether to purchase the Company’s common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this Prospectus. We cannot assure you that any of the events discussed below will not occur. These events could have a material and adverse impact on our business, financial condition, results of operations and prospects. If that were to happen, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Liquidity, the Company’s Business and Industry

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

We were incorporated under the laws of Nevada on February 26, 2020. Accordingly, we have no significant history upon which an evaluation of our prospects and future performance can be made. Our proposed operations are subject to all of the business risks associated with a new enterprise. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the inception of a business, operation in a competitive industry, and the continued development of our technology and the results of our clinical data. We anticipate that our operating expenses will increase for the near future. There can be no assurances that we will ever operate profitably. You should consider the Company’s business, operations and prospects in light of the risks, expenses and challenges faced as an early-stage company.

If we are unable to attract and retain key management, scientific personnel and advisors, we may not achieve our business objectives.

Our success depends on the availability and contributions of members of our senior management team. The loss of services of any of these individuals could delay, reduce or prevent our drug development and other business objectives. Furthermore, recruiting and retaining qualified scientific personnel to perform drug development work will be critical to our success. We face intense competition for qualified individuals from numerous pharmaceutical and biotechnology companies, universities, governmental entities and other public and private research institutions. We may be unable to attract and retain these individuals, and our failure to do so could materially adversely affect our business and financial condition.

| 8 |

The development of our technology, products, and services is highly competitive.

We face competition with respect to any products that we may seek to develop or commercialize in the future. Our competitors include major companies worldwide. Many of our competitors have significantly greater financial, technical and human resources than we have and superior expertise in research and development and marketing approved products/services and thus may be better equipped than us to develop and commercialize products/services. These competitors also compete with us in recruiting and retaining qualified personnel and acquiring technologies. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Accordingly, our competitors may commercialize products more rapidly or effectively than we are able to, which would adversely affect our competitive position, the likelihood that our products/services will achieve initial market acceptance and our ability to generate meaningful additional revenues from our products.

From time to time, third parties may claim that one or more of our products or services infringe their intellectual property rights.

Any dispute or litigation regarding patents or other intellectual property could be costly and time consuming due to [the complexity of our technology and] the uncertainty of intellectual property litigation and could divert our management and key personnel from our business operations. A claim of intellectual property infringement could force us to enter into a costly or restrictive license agreement, which might not be available under acceptable terms or at all, could require us to redesign our products, which would be costly and time-consuming, and/or could subject us to an injunction against development and sale of certain of our products or services. We may have to pay substantial damages, including damages for past infringement if it is ultimately determined that our products infringe on a third party’s proprietary rights. Even if these claims are without merit, defending a lawsuit takes significant time, may be expensive and may divert management’s attention from other business concerns. Any public announcements related to litigation or interference proceedings initiated or threatened against us could cause our business to be harmed. Our intellectual property portfolio may not be useful in asserting a counterclaim, or negotiating a license, in response to a claim of intellectual property infringement. In certain of our businesses we rely on third party intellectual property licenses and we cannot ensure that these licenses will be available to us in the future on favorable terms or at all.

Although dependent on certain key personnel, the Company does not have any key man life insurance policies on any such people.

The Company is dependent on Vininder Singh in order to conduct its operations and execute its business plan and the loss of Vininder Singh or any member of the board of directors or executive officer could harm the Company’s business, financial condition, cash flow and results of operations.; however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if Vininder Singh or any member of the board of directors or an executive officer dies or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and its operations.

The Company’s business operations may be materially adversely affected by a pandemic such as the Coronavirus COVID-19) outbreak.

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which spread throughout other parts of the world, including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID- 19) a “Public Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared a public health emergency for the United States to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020 the World Health Organization characterized the outbreak as a “pandemic.” COVID-19 resulted in a widespread health crisis that adversely affected the economies and financial markets worldwide. The Company’s business could be materially and adversely affected. The extent to which COVID-19 impacts the Company’s business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. If the disruptions posed by COVID-19 or other matters of global concern continue for an extended period of time, the Company’s operations may be materially adversely affected. A chief concern related to such events is that they could cause a disruption to our clinical trials.

| 9 |

New product development involves a lengthy, expensive and complex process.

We may be unable to develop or commercialize any product candidates. Moreover, even if we develop such candidates, they may be subject to significant regulatory review, approval and other government regulations. There can be no assurance that our technologies will be capable of developing and commercializing products at all. New product development involves a lengthy, expensive and complex process and we currently have no fully validated diagnostic candidates. In addition, before we can commercialize any new product candidates, we will need to:

| ● | conduct substantial research and development; | |

| ● | conduct validation studies; | |

| ● | expend significant funds; | |

| ● | develop and scale-up our laboratory processes; and | |

| ● | obtain regulatory approval and acceptance of our product candidates. |

This process involves a high degree of risk and takes several years. Our product development efforts may fail for many reasons, including:

| ● | failure of the product at the research or development stage; and | |

| ● | lack of clinical validation data to support the effectiveness of the product. |

Few research and development projects result in commercial products, and perceived viability in early clinical trials often is not replicated in later studies. At any point, we may abandon development of a product candidate or we may be required to expend considerable resources repeating clinical trials, which would adversely impact the timing for generating potential revenues from those product candidates. In addition, as we develop product candidates, we will have to make significant investments in product development, marketing and sales resources.

We may not be able to conduct clinical trials necessary to increase the value of our proposed products and formulations.

In order to conduct clinical trials that are necessary to obtain approval of a product by the FDA, it is necessary to receive clearance from the FDA to conduct such clinical trials. The FDA can halt clinical trials at any time for safety reasons or because we or our clinical investigators do not follow the FDA’s requirements for conducting clinical trials. If we are unable to receive clearance to conduct clinical trials or the trials are halted by the FDA, the likelihood of our ability to sell or license our products would be greatly reduced as it is the FDA approval which will enhance the value of our products.

Our ability to resell and/or license our products will depend upon successful clinical trials.

Only a small number of research and development programs result in the development of a product that obtains FDA approval.. Success in preclinical work or early stage clinical trials does not ensure that later stage or larger scale clinical trials will be successful. Conducting clinical trials is a complex, time-consuming and expensive process. Our ability to complete our clinical trials in a timely fashion depends in large part on a number of key factors including protocol design, regulatory and institutional review board approval, the rate of patient enrollment in clinical trials, and compliance with extensive current Good Clinical Practices. If we fail to adequately manage the design, execution and regulatory aspects of our clinical trials, our studies and ultimately our regulatory approvals may be delayed, or we may fail to gain approval for our product candidates. Clinical trials may indicate that our product candidates have harmful side effects or raise other safety concerns that may significantly reduce the likelihood of regulatory approval, result in significant restrictions on use and safety warnings in any approved label, adversely affect placement within the treatment paradigm, or otherwise significantly diminish the commercial potential of the product candidate. Also, positive results in a registrational trial may not be replicated in any subsequent confirmatory trials. Even if later stage clinical trials are successful, regulatory authorities may disagree with our view of the data or require additional studies, and may fail to approve or delay approval of our product candidates or may grant marketing approval that is more restricted than anticipated, including indications for a narrower patient population than expected and the imposition of safety monitoring or educational requirements or risk evaluation and mitigation strategies. In addition, if another Company is the first to file for marketing approval of a competing drug candidate, that Company may ultimately receive marketing exclusivity for its drug candidate, thereby reducing the value of our product.

| 10 |

We face significant competition from other biotechnology and pharmaceutical companies.

While we believe that our technology, development experience and scientific knowledge provide competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical, and biotechnology companies, academic institutions and governmental agencies, and public and private research institutions. Many of our existing or potential competitors have substantially greater financial, technical and human resources than we do and significantly greater experience in the development of drug candidates as well as in obtaining regulatory approvals of those drug candidates in the United States and in foreign countries.

Mergers and acquisitions in the pharmaceutical and biotechnology industries could result in even more resources being concentrated among a small number of our competitors. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring or licensing, on an exclusive basis, drug candidates that are more effective or less costly than any drug candidate that we may develop.

Our ability to compete successfully will depend largely on our ability to:

* identify drugs that have suffered set backs in the clinical development and regulatory process which we believe can be assisted by our platform’s ability to design a better study group;

* attract qualified scientific, product development and commercial personnel;

* obtain patent or other proprietary protection for our drugs and technologies;

* obtain required regulatory approvals; successfully collaborate with pharmaceutical companies in the discovery, development and commercialization of new drugs; and

* negotiate competitive pricing and reimbursement with third party payors

The availability of our competitors’ technologies could limit the demand, and the price we are able to charge for our services and for any drug candidate we develop. The inability to compete with existing or subsequently introduced drug development technologies would have a material adverse impact on our business, financial condition and prospects.

Established pharmaceutical companies and research institutions may invest heavily to accelerate discovery and development of novel compounds or to in license novel compounds that could make bfLEAP™ less competitive, which would have a material adverse impact on our business.

We may not be able to acquire the rights to any failed drugs or we may not be able to rescue failed drugs through analysis due to our technology or the lack of clinical data.

Our business model is based on the use of AI/ML technology, which technology may not uncover actionable insights or we may not be able to access sufficient clinical data to uncover such insights that lead to a successful project, clinical trial, or product. The failure of such projects, clinical trials or products would result in a loss of revenue from one of our three sources, which could have a material adverse impact on our business as a whole.

We may not succeed in acquiring the rights to failed drugs, which could limit one of our main sources of revenue.

Our business model is partly based on our ability to acquire drugs that have failed to pass Phase 2 or Phase 3 of the FDA approval process; however, there is no guarantee that we will be able to acquire the rights to such drugs, which would significantly impact our ability to generate revenue and as a result would have a material adverse impact on our business.

We intend to invest in early stage experimental technologies which have a high risk of failure.

To continue supporting our business model, we intend to invest in early stage and experimental technologies, some or all of which may not be useful to us. There is a risk that we will invest in technology that will not ultimately contribute to the success of our projects, which could have a material adverse impact on our business.

We are dependent on our collaborative agreements for the development of products and business development, which exposes us to the risk of reliance on the viability of third parties.

In conducting our research and development activities, we currently rely, and will in the future rely, on collaborative agreements with third parties such as manufacturers, contract research organizations, commercial partners, universities, governmental agencies and not-for-profit organizations for both strategic and financial resources. The loss of, or failure to perform by us or our partners under, any applicable agreements or arrangements, or our failure to secure additional agreements for other products in development, would substantially disrupt or delay our research and development and commercialization activities. Any such loss would likely increase our expenses and materially harm our business, financial condition and results of operation.

| 11 |

We extensively outsource our clinical trial activities and usually perform only a small portion of the start-up activities in-house.

We rely on independent third-party contract research organizations (CROs) to perform most of our clinical studies, including document preparation, site identification, screening and preparation, pre-study visits, training, program management and bioanalytical analysis. Many important aspects of the services performed for us by the CROs are out of our direct control. If there is any dispute or disruption in our relationship with our CROs, our clinical trials may be delayed. Moreover, in our regulatory submissions, we rely on the quality and validity of the clinical work performed by third-party CROs. If any of our CROs’ processes, methodologies or results were determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals could be adversely impacted.

We are a biotechnology company with no significant revenue. We have incurred operating losses since our inception, and we expect to incur losses for the foreseeable future and may never achieve profitability.

We have incurred significant operating losses since our inception. To date, we have not generated any revenue and we may not generate any revenue from sales of our clinical analytics services or drug candidates for the foreseeable future. We expect to continue to incur significant operating losses and we anticipate that our losses may increase substantially as we expand our drug development programs.

To achieve profitability, we must successfully develop and obtain regulatory approval for one or more of drugs and effectively commercialize any drugs we develop. Even if we succeed in developing and commercializing one or more drug candidates, we may not be able to generate sufficient revenue and we may never be able to achieve or sustain profitability.

We will continue to require additional capital for the foreseeable future. If we are unable to raise additional capital when needed, we may be forced to delay, reduce or eliminate our drug acquisition efforts.

We expect to continue to incur significant operating expenses in connection with our ongoing activities, including conducting clinical trials and seeking regulatory approval of drug candidates. Our ongoing future capital requirements will depend on numerous factors, including:

| ● | the rate of progress, results and costs of completion of clinical trials of drug candidates; | |

| ● | the size, scope, rate of progress, results and costs of completion of any potential future clinical | |

| ● | trials and preclinical tests of our drug candidates that we may initiate; | |

| ● | the costs of obtaining regulatory approval of drug candidates; | |

| ● | the scope, prioritization and number of drug development programs we pursue; | |

| ● | the costs for preparing, filing, prosecuting, maintaining and enforcing our intellectual property | |

| ● | rights and defending intellectual property-related claims; | |

| ● | the extent to which we acquire or in-license other products and technologies and the costs to be able to obtain regulatory approval of such products; | |

| ● | our ability to establish strategic collaborations and licensing or other arrangements on terms | |

| ● | favorable to us; and | |

| ● | competing technological and market developments. |

Any additional fundraising efforts may divert our management from their day to day activities, which may adversely affect our ability to identify and acquire new drug candidates and to further the regulatory process of such productsts.. Our ability to raise additional funds will depend, in part, on the success of our product development activities and other factors related to financial, economic and market conditions, many of which are beyond our control. There can be no assurance that we will be able to raise additional capital when needed or on terms that are favorable to us, if at all. If adequate funds are not available on a timely basis, we may be forced to:

| ● | delay, reduce the scope of or eliminate one or more of our drug development programs; |

| 12 |

| ● | limit the amount of new products that we acquire or relinquish, license or otherwise dispose of rights on terms that are less favorable than if we were able to further the regulatory approval process; or | |

| ● | liquidate and dissolve the Company. |

If our operating plans change, we may require additional capital sooner than planned. Such additional financing may not be available when needed or on terms favorable to us. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe we have sufficient funds for our current and future operating plan.

We are increasingly dependent on information technology systems to operate our business and a cyber-attack or other breach of our systems, or those of third parties on whom we may rely, could subject us to liability or interrupt the operation of our business.

We are increasingly dependent on information technology systems to operate our business. A breakdown, invasion, corruption, destruction or interruption of critical information technology systems by employees, others with authorized access to our systems or unauthorized persons could negatively impact operations. In the ordinary course of business, we collect, store and transmit confidential information and it is critical that we do so in a secure manner to maintain the confidentiality and integrity of such information. Additionally, we outsource certain elements of our information technology systems to third parties. As a result of this outsourcing, our third party vendors may or could have access to our confidential information making such systems vulnerable. Data breaches of our information technology systems, or those of our third party vendors, may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. For example, the loss of clinical trial data from completed or ongoing clinical trials or preclinical studies could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. While we believe that we have taken appropriate security measures to protect our data and information technology systems, and have been informed by our third party vendors that they have as well, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems, or those of our third party vendors, that could materially adversely affect our business and financial condition.

We must complete extensive clinical trials to demonstrate the safety and efficacy of our drug candidates. If we are unable to demonstrate the safety and efficacy of our drug candidates, we will not be successful.

The success of our business depends primarily on our ability to further the regulatory approval process to increase the value of our drug candidates.. Drug candidates must satisfy rigorous standards of safety and efficacy before they can be approved for sale which greatly enhances their value. To satisfy these standards, we must engage in expensive and lengthy testing of drug candidates.

We may not be able to obtain authority from the FDA or other equivalent foreign regulatory agencies to move on to further efficacy segments of the Phase 2 or Phase 3 clinical trials or commence and complete any clinical trials for any of our drug candidates. Positive results in preclinical studies of a drug candidate may not be predictive of similar results in human clinical trials, and promising results from early clinical trials of a drug candidate may not be replicated in later clinical trials. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in early-stage development. Accordingly, the results from the preclinical tests or clinical trials for our drug candidates may not be predictive of the results we may obtain in later stage trials. The failure of clinical trials to demonstrate safety and efficacy of one or more of our drug candidates will have a material adverse effect on our business and financial condition.

Delays in the commencement of clinical trials of our drug candidates could result in increased costs to us and delay our ability to successfully license or sell such products.

Our drug candidates will require continued extensive clinical trials to increase the value and desirability of the products. Because of the nature of clinical trials, we do not know whether future planned clinical trials will begin on time, if at all. Delays in the commencement of clinical trials could significantly increase our drug development costs and delay our ability to successfully sell or license our drug candidates. In addition, many of the factors that may cause, or lead to, a delay in the commencement of clinical trials may also ultimately lead to denial of regulatory approval of a drug candidate. The commencement of clinical trials can be delayed for a variety of reasons, including delays in:

| ● | demonstrating sufficient safety and efficacy in past clinical trials to obtain regulatory approval | |

| ● | to commence a further clinical trial; |

| 13 |

| ● | convincing the FDA that we have selected valid endpoints for use in proposed clinical trials; and | |

| ● | obtaining institutional review board approval to conduct a clinical trial at a prospective site. |

In addition, the commencement of clinical trials may be delayed due to insufficient patient enrollment, which is a function of many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites, the availability of effective treatments for the relevant disease and the eligibility criteria for the clinical trial.

If we are unable to obtain U.S. and/or foreign regulatory approval, we will be unable to resell or license our drug candidates.

Our drug candidates will be subject to extensive governmental regulations relating to, among other things, research, testing, development, manufacturing, safety, efficacy, record keeping, labeling, marketing and distribution of drugs. Rigorous preclinical testing and clinical trials and an extensive regulatory approval process are required in the U.S. and in many foreign jurisdictions prior to the commercial sale of drug candidates. Satisfaction of these and other regulatory requirements is costly, time consuming, uncertain and subject to unanticipated delays. It is possible that no drug candidate that we present to the FDA will obtain marketing approval which will significantly diminish the value and desirability of our product candidates. In connection with the clinical trials for our drug candidates, we face risks that:

| ● | the drug candidate may not prove to be efficacious; | |

| ● | the drug candidate may not prove to be safe; | |

| ● | the drug candidate may not be readily co-administered or combined with other drugs or drug | |

| ● | candidates; | |

| ● | the results may not confirm the positive results from earlier preclinical studies or clinical trials; | |

| ● | the results may not meet the level of statistical significance required by the FDA or other | |

| ● | regulatory agencies; and | |

| ● | the FDA or other regulatory agencies may require us to carry out additional studies. |

We have limited experience in conducting and managing later stage clinical trials necessary to obtain regulatory approvals, including approval by the FDA. However, this risk would be mitigated in the event the Company is successful entering into a co-development agreement with a pharma partner for late stage clinical development. The time required to complete clinical trials and for the FDA and other countries’ regulatory review processes is uncertain and typically takes many years. Our analysis of data obtained from preclinical and clinical trials is subject to confirmation and interpretation by regulatory authorities, which could delay, limit or prevent regulatory approval. We may also encounter unanticipated delays or increased costs due to government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials, and FDA regulatory review.

We will rely on third parties for manufacturing of our clinical drug supplies; our dependence on these manufacturers may impair the development of our drug candidates.

We have no ability to internally manufacture the drug candidates that we need to conduct our clinical trials for the products that we acquire. For the foreseeable future, we expect to continue to rely on third-party manufacturers and other third parties to produce, package and store sufficient quantities of our drug candidates and any future drug candidates for use in our clinical trials. We may face various risks and uncertainties in connection with our reliance on third-party manufacturers, including:

| ● | reliance on third-party manufactures for regulatory compliance and quality assurance; | |

| ● | the possibility of breach of the manufacturing agreement by the third-party manufacturer because | |

| ● | of factors beyond our control; | |

| ● | the possibility of termination or nonrenewal of our manufacturing agreement by the third-party | |

| ● | manufacturer at a time that is costly or inconvenient for us; | |

| ● | the potential that third-party manufacturers will develop know-how owned by such third-party | |

| ● | manufacturer in connection with the production of our drug candidates that is necessary for the | |

| ● | manufacture of our drug candidates; and | |

| ● | reliance on third-party manufacturers to assist us in preventing inadvertent disclosure or theft of | |

| ● | our proprietary knowledge. |

| 14 |

Our drug candidates may be complicated and expensive to manufacture. If our third-party manufacturers fail to deliver our drug candidates for clinical use on a timely basis, with sufficient quality, and at commercially reasonable prices, we may be required to delay or suspend clinical trials or otherwise discontinue development of our drug candidates. While we may be able to identify replacement third-party manufacturers or develop our own manufacturing capabilities for these drug candidates, this process would likely cause a delay in the availability of our drug candidates and an increase in costs. In addition, third-party manufacturers may have a limited number of facilities in which our drug candidates can be manufactured, and any interruption of the operation of those facilities due to events such as equipment malfunction or failure or damage to the facility by natural disasters could result in the cancellation of shipments, loss of product in the manufacturing process or a shortfall in available drug candidates.

We may rely on technology solution partners for the development and deployment of our AI technology

Our partners may experience technical, financial, operational, or security issues that reduce or eliminate their ability to support the Company. This could prevent the Company from generating revenue and eliminate our ability to operate.

In addition to the risks listed above, businesses are often subject to risks not foreseen or fully appreciated by the management. It is not possible to foresee all risks that may affect us. Moreover, the Company cannot predict whether the Company will successfully effectuate the Company’s current business plan. Each prospective Purchaser is encouraged to carefully analyze the risks and merits of an investment in the Securities and should take into consideration when making such analysis, among other, the Risk Factors discussed above.

Risks Related to Intellectual Property Rights

We rely on various intellectual property rights, including patents and licenses in order to operate our business.

Our intellectual property rights, may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights.

As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

| 15 |

The Company could be negatively impacted if found to have infringed on intellectual property rights.