UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended:

For the transition period from [ ] to [ ]

Commission

file number

(Name of small business issuer in its charter)

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

(Address of Principal Executive Offices)

Issuer’s

telephone number:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| The Stock Market LLC (The Nasdaq Capital Market) | ||||

| The

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if registrant is a well-known seasoned issuer, as defined under Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report to its management’s assessment of the effectiveness of its internal control

over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm

that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

The registrant was not a public company as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, and therefore it cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates at such date. The registrant’s Common Stock began trading on the Nasdaq Capital Market on February 14, 2023.

As of April 14, 2023, there were shares of the registrant’s common stock, par value $0.00001 per share, issued and outstanding.

Documents

incorporated by reference:

TABLE OF CONTENTS

In this report, unless the context indicates otherwise, the terms “Company,” “we,” “us,” “our” and similar words refer to Bullfrog AI Holdings, Inc. (“Bullfrog”), a Nevada corporation.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934 or the “Exchange Act.” These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or anticipated results.

In some cases, you can identify forward-looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management’s current expectations and beliefs, which management believes are reasonable. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to a number of factors, including:

● our future financial performance, including our revenue, costs of revenue, operating expenses and profitability;

● the sufficiency of our cash and cash equivalents to meet our liquidity needs;

● our predictions about the property development, digital transformation technology and biohealth businesses and their respective market trends;

● our ability to attract and retain customers in all our business segments to purchase our products and services;

● the availability of financing for smaller publicly traded companies like us;

● our ability to successfully expand in our three principal business markets and into new markets and industry verticals; and

● our ability to effectively manage our growth and future expenses.

Other risks and uncertainties include such factors, among others, as market acceptance and market demand for our products and services, pricing, the changing regulatory environment, the effect of our accounting policies, industry trends, adequacy of our financial resources to execute our business plan, our ability to attract, retain and motivate key personnel, and other risks described from time to time in periodic and current reports we file with the United States Securities and Exchange Commission, or the “SEC.” You should consider carefully the statements under this report, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements and could materially and adversely affect our business, operating results and financial condition. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements.

| 1 |

PART I

ITEM 1. BUSINESS

Our Corporate History and Background

BullFrog AI Holdings, Inc. was incorporated in the State of Nevada on February 18, 2020. Our principal business address is 325 Ellington Blvd, Unit 317, Gaithersburg, MD 20878. All of our operations are currently conducted through BullFrog AI Holdings, Inc. BullFrog AI, Inc., a wholly owned subsidiary acquired through a share exchange, has the sole purpose of housing and protecting all of the organization’s intellectual property. BullFrog AI Management, LLC is a wholly owned subsidiary that handles all HR and payroll activities.

Acquisition of BullFrog AI

In March 2020, BullFrog AI, Inc. received an investment from TEDCO - the Technology Development Corporation of Maryland, a State of Maryland Investment Fund – pursuant to the issuance of a $200,000 convertible note with an 18-month term, 6% annual interest rate, and a 20% discount. In June 2020, BullFrog AI Holdings, Inc. acquired BullFrog AI, Inc. pursuant to an exchange agreement under which each share of Bull Frog AI, Inc. common stock was exchanged for a share of common stock of BullFrog AI Holdings, Inc.. Immediately prior to the share exchange, each outstanding common share of BullFrog AI, Inc. was split into 25 shares of common stock. Share amounts in our financial statements for 2021 and 2020 have been adjusted to reflect this forward share split and shares exchange. Pursuant to the agreement, 24,223,975 shares of the Company’s common stock were issued to the shareholders of BullFrog AI, Inc. in exchange for 100% of the outstanding stock of BullFrog AI, Inc. Upon completion of the exchange, BullFrog AI, Inc. became the Company’s wholly-owned subsidiary and the shareholders of BullFrog AI, Inc. held 100% of the common stock of the Company. As a result, BullFrog AI Holdings, Inc. assumed a total of $330,442 in net liabilities of BullFrog AI, Inc. Both of the entities were controlled before and after the transactions by the same controlling shareholder. This transaction is being accounted for as a common control transaction and all entities are being presented as if the transactions took place at the beginning of the earliest period presented.

BullFrog AI Corporate History

BullFrog AI, Inc. was incorporated in the State of Delaware on August 25, 2017. Vininder Singh is the founder, CEO and chairman of BullFrog AI.

Our Strategy

We plan to achieve our business objectives by enabling the successful development of drugs and biologics using a precision medicine approach via our proprietary artificial intelligence platform bfLEAP. We will execute our plan by doing all or any of the following: partnering with biopharmaceutical companies in a fee for service model to assist and enable them with their drug development programs, acquiring rights to and rescuing drugs that have failed FDA review following pivotal Phase 2 or Phase 3 clinical trials (we refer to this rescue process as “drug rescue”), acquiring rights to drugs that are in early stage clinical trials and have not failed FDA review, and discovering new drugs and biologics.

The process for enhancing and developing late-stage failed drugs is to:

| ● | acquire the rights to the failed drug from a biopharmaceutical industry company or university, | |

| ● | use the proprietary bfLEAP™ AI/ML platform to determine a multi-factorial profile for a patient that would best respond to the drug, | |

| ● | Rapidly conduct a clinical trial likely with a partner to validate the drug’s use for the defined “high-responder” population; and | |

| ● | Divest/sell the rescued drug asset with new information back to the pharma industry, following positive results of the clinical trial. |

We also plan to deploy this strategy for all discovery and early stage clinical candidates. The common objective is to monetize our assets as quickly as possible with no current plan to commercialize any asset. As part of our strategy, we will continue evolving our intellectual property, analytical platform and technologies, build a large portfolio of drug candidates, and implement a model that reduces risk and increases the frequency of cash flow from rescued drugs. This strategy will include strategic partnerships, collaborations, and relationships along the entire business value chain.

| 2 |

We did not produce any revenues through 2021; we generated our first revenues in late 2022 from our services related to the relationship with a pharmaceutic company.

To date, we have not conducted clinical trials on any pharmaceutical drugs and our platform has not been used to identify a drug candidate that has received regulatory approval for commercialization. However, we currently have a strategic relationship with a leading rare disease non-profit organization for artificial intelligence/machine learning (“AI/ML”) analysis of late stage clinical data. We have acquired the rights to a series of preclinical and early clinical drug assets from universities and entered into a strategic collaboration with a world renowned research institution to create a HSV1 viral therapeutic platform to engineer immunotherapies for colorectal cancer. We have signed exclusive worldwide license agreements with Johns Hopkins University for a cancer drug that targets glioblastoma (brain cancer), pancreatic cancer, and other cancers. We have also signed an exclusive worldwide license with George Washington University for another cancer drug that targets hepatoceullar carcinoma (liver cancer), and other liver diseases.

Our platform was originally developed by The Johns Hopkins University Applied Physics Laboratory (“JHU-APL”). JHU-APL uses the same technology for applications related to national defense. Over several years, the software and algorithms have been used to identify relationships, patterns, and anomalies, and make predictions that otherwise may not be found. These discoveries and insights provide an advantage when predicting a target of interest, regardless of industry or sector. We have applied the technology to various clinical data sets and have identified novel relationships that may provide new intellectual property, new drug targets, and other valuable information that may help with patient stratification for a clinical trial thereby improving the odds for success. The platform has not yet aided in the development of a drug that has reached commercialization. However, we have licensed one drug candidate that has completed a Phase 1 trial and a second candidate that is in the preclinical stages. Our aim is to use our technology on current and future available data to help us better determine the optimal path for development.

Contract Services

Our fee for service partnership offering is designed for biopharmaceutical companies, as well as other organizations, of all sizes that have challenges analyzing data throughout the drug development process. We provide the customer with an analysis of large complex data sets using our proprietary artificial intelligence / machine learning platform called bfLEAP™. This platform is designed to predict targets of interest, patterns, relationships, and anomalies. Our service model involves a cash fee plus the potential for rights to new intellectual property generated from the analysis, which can be performed at the discovery, preclinical, or clinical stages of drug development. On September 28, 2022, BullFrog AI entered into a $185,000 service contract with Sapu Biosciences, LLC, a subsidiary of Oncotellic Therapeutics (OTCQB: OTLC). The scope of the contract is focused on uncovering novel insights related to oncology clinical data for one of their candidate programs.

Collaborative Arrangements

We will also seek to enter into collaborative arrangements with pharmaceutical companies who have drugs that have failed late Phase 2 or Phase 3 trials. Our revenue from such collaborations will be based on achieving certain milestones as determined by each specific arrangement.

Acquisition of Rights to Certain Drugs

In certain circumstances, we may also acquire rights to drugs that are in early stage clinical trials, use our technology to produce a successful later stage precision medicine trial, and divest the asset. The same process may apply to the discovery of new drugs.

| 3 |

Our Products

| Product/Platform | Description | Target Market/Indications | ||

| bfLEAP™ – AI/ML platform for analysis of preclinical and/or clinical data | AI/ML analytics platform derived from technology developed at JHU-APL and licensed by the Company. | Biotechnology and pharmaceutical companies and other organizations. | ||

| siRNA | siRNA targeting Beta2-spectrin in the treatment of human diseases developed at George Washington University licensed by the Company | Hepatocellular carcinoma (HCC), treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis. Has not yet initiated clinical testing. | ||

| Mebendazole | Improved formulation of Mebendazole developed at Johns Hopkins University and licensed by the Company | Glioblastoma. Has begun the process of clinical testing but has not received regulatory approval for commercialization. |

On January 14, 2022, the Company entered into an exclusive, worldwide, royalty-bearing license from George Washington University (GWU) for rights to use siRNA targeting Beta2-spectrin in the treatment of human diseases, including hepatocellular carcinoma (HCC). The license covers methods claimed in three U.S. and worldwide patent applications, and also includes use of this approach for treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis. This program is currently in the preclinical stage of development. The Company has not yet initiated development activities or IND-enabling studies on this asset; however, the plan is to conduct this work over the next 24 months. All R&D to date on this candidate has been conducted by the licensor of the technology, George Washington University.

Non-alcoholic fatty liver disease (NAFLD) is a condition in which excess lipids, or fat, build up in the liver. This condition, which is more common in people who have obesity and related metabolic diseases including type 2 diabetes, affects as many as 24% of adults in the US and is associated with risk of progression to more serious conditions, including non-alcoholic steatohepatitis (NASH), with associated liver inflammation and fibrosis, and HCC. Evidence in animal models of obesity suggest that a protein called β2-spectrin may play a key role in lipid accumulation, tissue fibrosis, and liver damage, and targeting expression or activity of this protein may be a useful approach in treating NASH and liver cancer (Rao et al., 2021).

In February 2022, the Company entered into an exclusive, worldwide, royalty-bearing license from Johns Hopkins University (JHU) for the use of an improved formulation of Mebendazole for the treatment of any human cancer or neoplastic disease. This formulation shows potent activity in animal models of different types of cancer and has been evaluated in a Phase I clinical trial in patients with high-grade glioma (NCT01729260). The trial, an open-label dose-escalation study, assessed the safety of the improved formulation with adjuvant temozolomide in 24 patients with newly diagnosed gliomas. Investigators observed no dose-limiting toxicity in patients receiving all but the highest tested dose (200mg/kg/day). Four of the 15 patients receiving the maximum tested dose of 200mg/kg/day experienced dose-limiting toxicity, all of which were reversed by decreasing or eliminating the dose given. There were no serious adverse events attributed to mebendazole at any dose during the trial. The Company is currently formulating a strategy to find a partner to conduct additional clinical trials with this asset to enable evaluation of safety in humans.

We are able to leverage our drug rescue business by leveraging a powerful and proven AI/ML platform (trade name: bfLEAP™) initially derived from technology developed at JHU-APL. The bfLEAP™ analytics platform is a potentially disruptive tool for analysis of pre-clinical and/or clinical data sets, such as the robust pre-clinical and clinical trial data sets being generated in translational R&D and clinical trial settings. The input data for bfLEAP™ can include raw data (preclinical and/or clinical readouts), categorical data, sociodemographic data of patients, and various other inputs. Thus, the bfLEAP™ platform is capable of capturing the “human experience” of patients in an unbiased manner, and contextualizing it against other disparate data sources from patients (e.g. molecular data, physiological data, etc.) for less biased and more meaningful conclusions (i.e. more ethical AI/ML). It is also uniquely scalable – the bfLEAP™ platform is able to perform analysis on large, high-volume data sets (i.e. ‘big data’) and also able to analyze highly disparate “short and wide” data as well. In terms of visualization, bfLEAP™ is able to integrate with most commonly used visualization tools for graph analytics.

We believe the combination of a) scalable analytics (i.e., large data or short/wide data), b) state-of-the-art algorithms, c) unsupervised machine learning, and d) streamlined data ingestion/visualization makes bfLEAP™ one of the most flexible and powerful new platforms available on the market.

| 4 |

Our Platform Technology

We will continue to evolve and improve bfLEAP™, either in-house or with development partners like JHU-APL. The bfLEAP™ platform is based on an exclusive, worldwide license granted by JHU.

We plan to leverage our proprietary AI/ML platform developed over several years at one of the top innovation institutions in the world which has already been successfully applied in multiple sectors. In terms of underlying intellectual property, we have secured a worldwide exclusive license from JHU-APL for the technology – this license covers 3 issued patents, as well as 1 new provisional patent application, non-patent rights to proprietary libraries of algorithms and other trade secrets, and also includes modifications and improvements. In addition, we have a unique business model designed to reduce risk and increase the frequency of cash flow.

The Company has recently licensed new technology from JHU-APL to evolve the bfLEAP platform to bfLEAP 2.0. This new and improved platform will enable more robust analysis of data with faster and higher precision prediction of the most important variables for identifying patient response to a drug.

Going forward, the Company will continue to evolve the platform and either develop or acquire new capabilities and technologies. These development efforts may be in house or in collaboration with an existing or new technology partners. The Company plans on hiring talent in data science and software development to bolster its in house capabilities.

Summary for CATIE Schizophrenia Case Study

The Company worked with the Lieber Institute for Brain Development to analyze data from the landmark CATIE trials. The CATIE trials were the largest trials ever conducted for anti-psychotic medications. BullFrog analyzed CATIE data from ~200 schizophrenia patients, with a library of almost 1 million genetic data points for each patient, more than 200 non-genetic attributes per patient, and 4 different medications used in the trial. For each of the four medications used, bfLEAP™ analysis revealed new, previously unknown relationships between individual genetic variants and negative patient symptoms. The genetic loci identified represent potential druggable targets, as well as potential stratifying criteria for future clinical trials in schizophrenia.

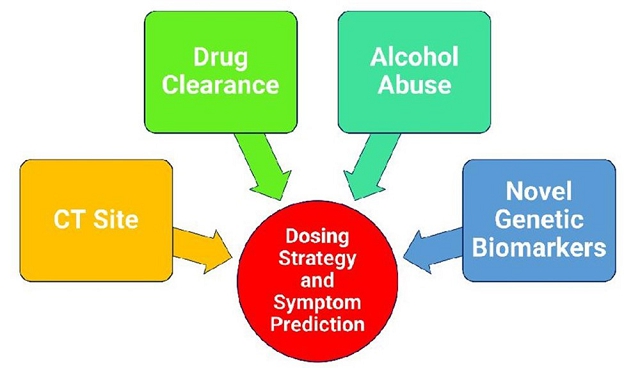

We performed another analysis on the data using our new advanced clustering algorithms bfLEAP 2.0 but focused on one particular drug named Olanzapine. Our bfLEAP™ 2.0 analytical results identified previously unknown, multi-dimensional associations among newly identified genetic variants, drug clearance, clinical trial sites, and clinical outcome variables in schizophrenia patients.

| 5 |

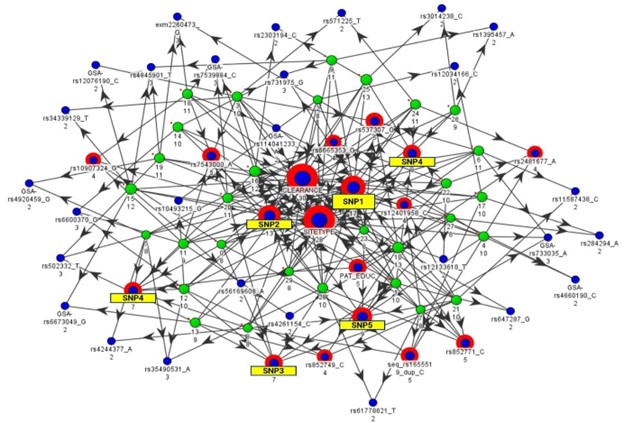

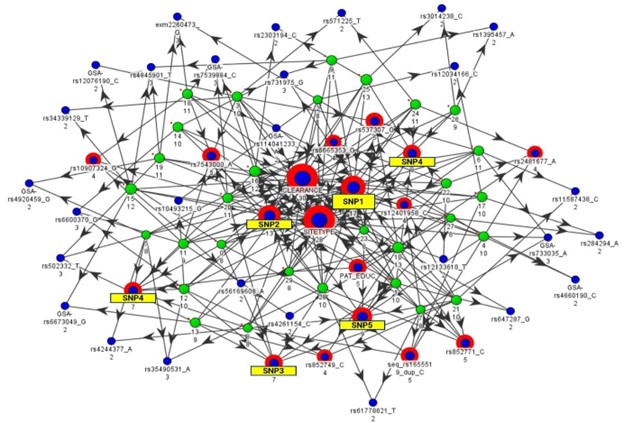

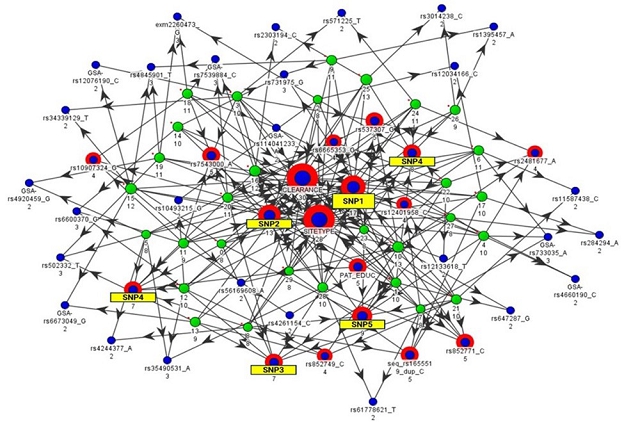

FIGURE 1 – bfLEAP™ Analytical Map

Each green node represents a different sampling of the data, and arrows point to attributes (blue nodes) which were found to be key indicators according to that sampling. Attribute importance is determined by how many samplings identify that attribute as an indicator (i.e., number of incoming arrows to each blue node).

| 6 |

Identification of clustered multi-variate associations (e.g., novel genetic variants, drug clearance, substance abuse) could help us 1) identify novel drug targets, 2) predict which patients are most likely to respond, and 3) identify modifiable factors that could contribute to better outcomes.

Summary for Cardiovascular Case Study

The Company worked with an international collaborator in cardiovascular devices to analyze data from an ongoing clinical trial for a new device. BullFrog analyzed data from ~55 patients, with a library of almost 15,000 unique attributes of data for each patient. The data also included adverse events, and key demographic information. For this collaborator, bfLEAP™ analysis was able to provide ground truth for the company - confirming multiple correlations and non-correlations within the data. In terms of actionable output, the analytical results confirmed at least two demographic co-variates for the ongoing trial, and also provided a starting point for deeper physiological and molecular studies.

Our Supply Chain and Customer Base

We have launched our businesses using funds from our initial public offering and through our partnerships and relationships. We have a strategic relationship with FSHD Society, a leading non-governmental organization, for AI/ML analysis of clinical trial data for patients with a rare neuromuscular disorder. We also have several other developing strategic relationships in the project design phase. The Company has executed a joint development deal for a biologics discovery phase opportunity that is directed toward targeted cancer therapeutics. The Company has also obtained exclusive worldwide rights to a Phase 2 ready glioblastoma drug and a discovery phase hepatocellular carcinoma drug from universities. Since we intend to conduct late-stage clinical trials with partners on rescued therapeutic assets, there will be a requirement of drug product or other significant services to plan and execute our clinical development programs. The success of our partnered clinical development programs will require adequate availability of raw materials and/or drug product for our R&D and clinical trials, and, in some cases, may also require establishment of third-party arrangements to obtain finished drug product that is manufactured appropriately under industry-standard guidelines, and packaged for clinical use or sale. Since we are a digital biopharmaceutical company, our clinical development programs will also require, in some cases, establishment of third-party relationships for execution and completion of clinical trials.

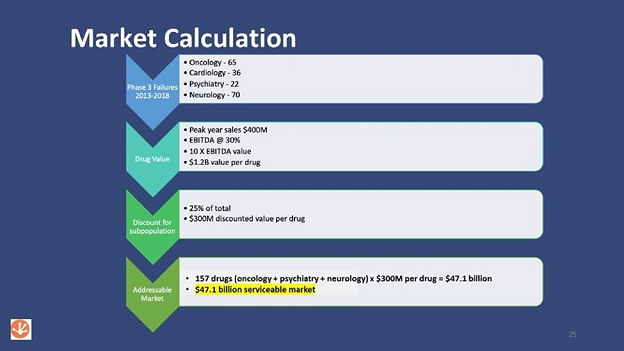

Our Market Opportunity

One aim of our business is to “rescue” drugs that have failed in phase 3 clinical trials by using our technology to analyze all available data with the goal of designing a precision medicine clinical trial that will have a better chance of being successful. The graphic below illustrates the estimated market opportunity for these failed drugs. The top arrow shows the number of failed phase 3 trials for several disease categories over a 5-year period. The arrows below provide our assumptions for narrowing or discounting certain parameters associated with the market size calculation. The final arrow shows the math behind the $47.1B. To date, we have not penetrated the failed drug market, however; we are actively searching for failed drug opportunities.

| 7 |

Identification of candidates with potential for rescue may be challenging and require significant resources, and once these assets are identified the Company may find it challenging to license them under favorable terms in order to create value for shareholders. Subsequent development of these assets for clinical testing may require significant effort and resources. Ultimately, these assets must undergo rigorous clinical testing and approval by FDA or comparable regulatory authorities in other countries in order to be marketed. A key part of our strategy is to partner our R&D programs. In addition, we do not intend on commercializing drugs and instead will seek to divest each drug asset to a company that will commercialize the drug. The Company may receive future royalties in come transactions.

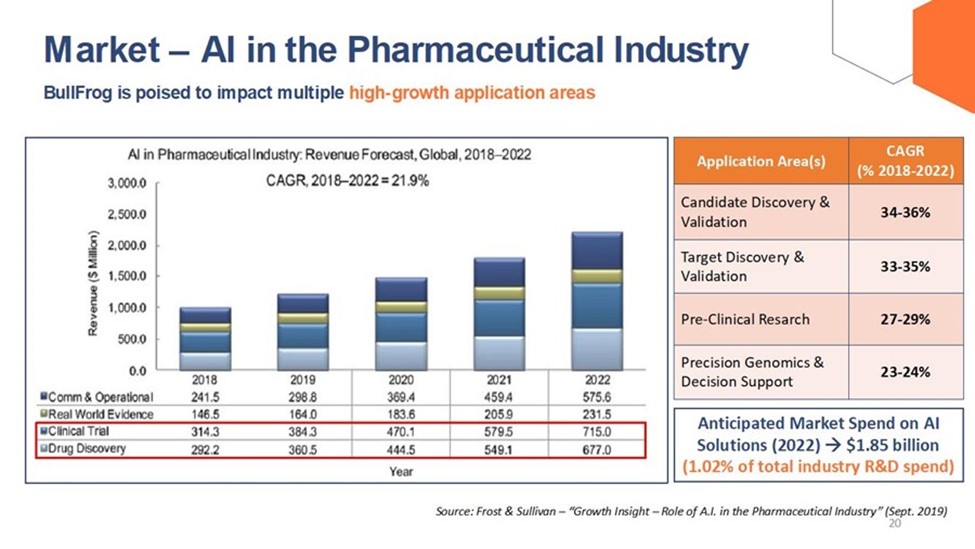

The following graphic illustrates the global revenue forecast for applying AI in the pharmaceutical industry, as well as the increase in anticipated market spend and annual growth rate for AI solutions per certain application areas.

| 8 |

Intellectual Property

Patents

We have exclusive worldwide rights to the following patents related to our intellectual property:

Johns Hopkins University Licensed Intellectual Property:

| Title | Serial Number | File Date | Application Type | Country | Status | Patent Number | Expiration Date | Assignee | ||||||||

| An Improved Formulation of Mebendazole and Drug Combination to Improve Anti-cancer Activity | 62/112,706 | 06 Feb 2015 | Provisional | US | Expired | The Johns Hopkins University | ||||||||||

| An Improved Formulation of Mebendazole and Drug Combination to Improve Anti-cancer Activity | PCT/US2016/016968 | 08 Feb 2016 | PCT | PCT - Parent | Expired | 11 Aug 2016 | The Johns Hopkins University | |||||||||

| MEBENDAZOLE POLYMORPH FOR TREATMENT AND PREVENTION OF TUMORS | 15/548,959 | 04 Aug 2017 | PCT | US | GRANTED | 11,110,079 | 08 Feb 2036 | The Johns Hopkins University | ||||||||

| Mebendazole Polymorph For Treatment And Prevention Of Tumors | 16747414.7 | 08 Feb 2016 | PCT | EPO | GRANTED | Pending | 08 Feb 2036 | The Johns Hopkins University | ||||||||

| MEBENDAZOLE POLYMORPH FOR TREATMENT AND PREVENTION OF TUMORS | 253854 | 08 Feb 2016 | PCT | Israel | GRANTED | 253854 | 08 Feb 2036 | The Johns Hopkins University | ||||||||

| An Improved Formulation of Mebendazole and Drug Combination to Improve Anti-cancer Activity | 2016800144274 | 08 Feb 2016 | PCT | China | GRANTED | 1ZL20168-0014427.4 | 08 Feb 2036 | The Johns Hopkins University | ||||||||

| An Improved Formulation of Mebendazole and Drug Combination to Improve Anti-cancer Activity | 201717028684 | 08 Feb 2016 | PCT | India | GRANTED | 352734 | 08 Feb 2036 | The Johns Hopkins University | ||||||||

| Mebendazole Polymorph For Treatment And Prevention Of Tumors | 2017-541687 | 08 Feb 2016 | PCT | Japan | GRANTED | 6796586 | 08 Feb 2036 | The Johns Hopkins University | ||||||||

| CONTINUATION: Mebendazole Polymorph For Treatment And Prevention Of Tumors | 17/402,131 | 13 Aug 2021 | CON | United States | PENDING | The Johns Hopkins University |

| 9 |

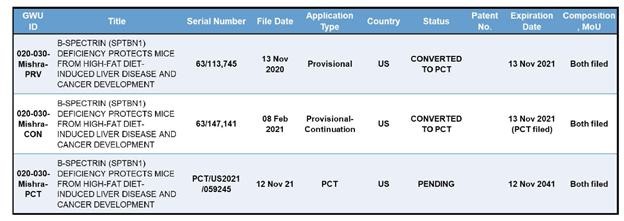

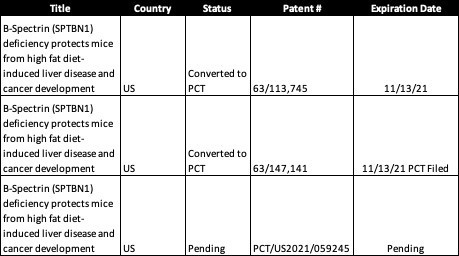

George Washington University Licensed Intellectual Property:

The provisional patent numbers 63/113,745 and 63/147,141 were both converted into a single PCT application (PCT/US2021/059245) with an expiration date of November 12, 2041, as shown in table below.

John Hopkins University Applied Physics Lab Licensed Intellectual Property:

| Title | Serial Number | File Date | Country | Status | Expiration Date | Assignee | ||||||

| Apparatus and Method for Distributed Graph Processing | U.S. Patent 10,146,801 | 7/13/2015 | US | Granted | 3/2/2037 | The Johns Hopkins University | ||||||

| Method and Apparatus for Analysis and Classification of High Dimensional Data Sets | U.S. Patent 10,936,965 | 10/5/2017 | US | Granted | 9/25/2038 | The Johns Hopkins University | ||||||

| Generalized Low Entropy Mixture Model | U.S. Patent 10,839,256 | 4/2/2018 | US | Granted | 12/15/2038 | The Johns Hopkins University |

Licenses

We hold the following licenses related to our intellectual property:

| Licensor | Licensee | Description of Rights Granted | ||

| Johns Hopkins University Applied Physics Lab | BullFrog AI, Inc. | Worldwide, exclusive rights for therapeutics development and analytical services | ||

| George Washington University | BullFrog AI Holdings | Worldwide, exclusive rights for therapeutics development | ||

| Johns Hopkins University | BullFrog AI Holdings | Worldwide, exclusive rights for therapeutics development |

| 10 |

On February 7, 2018, we entered into a License Agreement (the “License Agreement”) with JHU-APL, a Maryland limited liability company (“JHU”). Pursuant to the License Agreement, JHU-APL granted the Company exclusive rights to intellectual property of JHU related to analytical services for applications in biological and chemical derived pharmaceutical therapeutics. The License Agreement provides for the grant of an exclusive, worldwide, royalty-bearing license by JHU to the Company, with the right to sublicense, in order to conduct research using the patent rights and know-how and to develop and commercialize products in the field using the patent rights and know-how. In consideration of the rights granted to the Company under the License Agreement, the Company granted JHU received a warrant equal to five (5%) percent of the then fully diluted equity base of the Company, which was diluted following our public offering. Under the terms of the License Agreement, the Company is required to use commercially reasonable efforts to meet certain development milestones and minimum net sales milestones, and JHU will be entitled to eight (8%) percent of net sales for the services provided by the Company in which the JHU license was utilized, as well as fifty (50%) percent of all sublicense revenues received by the Company. In addition, the Company is required to pay JHU an annual maintenance fee of $1,500. The Company is also obligated to make minimum annual payments. These minimum annual payments to JHU were amended on September 3, 2020 to $20,000 in calendar year 2022, $80,000 in calendar year 2023, $300,000 in calendar year 2024, and $300,000 in calendar year 2025 and each year thereafter, which may be offset against royalties paid by the Company for the year in which the minimum annual royalty becomes due.

The License Agreement will, unless sooner terminated, continue in each country until the date of expiration of the last to expire patent included within the patent rights in that country, or if no patents issue, then for 10 years. The License Agreement may be terminated by the Company upon 60 days’ written notice in its discretion. The License Agreement may also be terminated by JHU if the Company is in material breach of the License Agreement and fails to cure such breach within a 60-day cure period commencing upon notice. A material breach by the Company may include a delinquency with respect to payment or the failure by the Company to timely achieve a specified milestone.

We also have exclusive, worldwide licenses to other intellectual property from JHU that are being held as trade secrets related to our algorithm libraries, pattern recognition, shallow-and-wide data sets, and time series correlation. We anticipate that new intellectual property (patents, copyrights, trademarks, trade secrets, etc.) will be generated through the course of executing our strategic development projects, and also through the course of improving, modifying, and scaling our bfLEAP™ platform. In October 2021, we amended the agreement with JHU-APL to include additional advanced AI technology. Currently, the latest patent grant date was in March 2021.

On July 8, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from JHU-APL for the additional technology (the “2022 License Agreement”). This license provides additional intellectual property rights including patents, copyrights and knowhow to be utilized under the Company’s bfLEAP™ analytical AI/ML platform. Under the terms of the 2022 License Agreement, JHU will be entitled to eight (8%) percent of net sales for the services provided by the Company to other parties and 3% for internally development drug projects in which the JHU license is utilized. The 2022 License Agreement also contains tiered sub licensing fees that start at 50% and reduce to 25% based on revenues. In addition, the Company is required to pay JHU an annual maintenance fee of $1,500. Minimum annual payments are set to be $30,000 for 2022, $80,000 for 2023, and $300,000 for 2024 and beyond, all of which are creditable by royalties. The financial terms of the new license agreement replace the original terms and are not duplicative.

George Washington University - Beta2-spectrin siRNA License

On January 14, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from GWU for rights to use siRNA targeting Beta2-spectrin in the treatment of human diseases, including HCC. The license covers methods claimed in three US and worldwide patent applications, and also includes use of this approach for treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis. This program is currently in the preclinical stage of development. The Company has not yet initiated development activities or IND-enabling studies on this asset; however, the plan is to conduct this work over the next 24 months. All R&D to date on this candidate has been conducted by the licensor of the technology, George Washington University. The term of the agreement began on January 14, 2022 and ends on the expiration date of the last patent to expire or 10 years after the first sale of a licensed product if no patents have issued. The license can be terminated by the licensee upon 60 days’ written notice, or by the licensor if the Company is more than 30 days late in paying amounts owed to the licensor and does not make payment upon demand, or in the event of any material breach of the license that is not cured within 45 days.

Non-alcoholic fatty liver disease (NAFLD) is a condition in which excess lipids, or fat, build up in the liver. This condition, which is more common in people who have obesity and related metabolic diseases including type 2 diabetes, affects as many as 24% of adults in the US and is associated with risk of progression to more serious conditions, including non-alcoholic steatohepatitis (NASH), with associated liver inflammation and fibrosis, and hepatocellular carcinoma (HCC). Evidence in animal models of obesity suggest that a protein called β2-spectrin may play a key role in lipid accumulation, tissue fibrosis, and liver damage, and targeting expression or activity of this protein may be a useful approach in treating NASH and liver cancer (Rao et al., 2021).

| 11 |

In consideration of the rights granted to the Company under the license agreement, GWU received a $20,000 License Initiation Fee. Under the terms of the License Agreement, GWU will be entitled to a three percent (3%) royalty on net sales subject to quarterly minimums once the first sale has occurred subsequent to regulatory approval, as well sublicense or assignment fees in the event the Company sublicenses or assigns their rights to use the technology. The Company will also reimburse GWU for previously incurred and ongoing patent costs. The Sublicense and Assignment fee amounts decline as the Company advances the clinical development of the licensed technology. The license agreement also contains milestone payments for clinical development through the approval of an NDA and commercialization.

Aggregate payments made to GWU to date include the $20,000 License Initiation Fee and an additional $6,550 to reimburse the licensor for past patent costs. Aggregate future milestone costs could reach $860,000 if the drug successfully completes clinical trials and is the subject of a New Drug Application (NDA) to the U.S. FDA. Future milestones on sales revenue are limited to $1M on the first $20M in net sales.

Johns Hopkins University – Mebendazole License

On February 22, 2022, the Company entered into an exclusive, worldwide, royalty-bearing license from JHU for the use of an improved formulation of Mebendazole for the treatment of any human cancer or neoplastic disease. This formulation shows potent activity in animal models of different types of cancer, and has been evaluated in a Phase I clinical trial in patients with high-grade glioma (NCT01729260). The trial, an open-label dose-escalation study, assessed the safety of the improved formulation with adjuvant temozolomide in 24 patients with newly diagnosed gliomas. Investigators observed no dose-limiting toxicity in patients receiving all but the highest tested dose (200mg/kg/day). Four of the 15 patients receiving the maximum tested dose of 200mg/kg/day experienced dose-limiting toxicity, all of which were reversed by decreasing or eliminating the dose given. There were no serious adverse events attributed to mebendazole at any dose during the trial. The Company is currently formulating a strategy to conduct additional clinical trials with this asset to enable evaluation of safety in humans.

The license covers six (6) issued patents and one (1) pending application, with the term of the agreement beginning on February 22, 2022 and ending on the date of expiration of the last to expire patent. The license can be terminated by the licensee upon 90 days’ written notice, or by the licensor in the event of any material breach of the license that is not cured within 30 days. In consideration of the rights granted to the Company under the license agreement, JHU will receive a staggered Upfront License Fee of $250,000, with the first $50,000 payment due within 30 days of the effective date. The Company will also reimburse JHU for previously incurred and ongoing patent costs. Under the terms of the license agreement, JHU will be entitled to three- and one-half percent (3.5%) royalty on net sales by the Company. In addition, the Company is required to pay JHU minimum annual royalty payments of $5,000 for 2023, $10,000 for 2024, $20,000 for 2025, $30,000 for 2026 and $50,000 for 2027 and each year after until the first commercial sale after which the annual minimum royalty shall be $250,000. The license agreement also contains milestone payments for clinical development steps through the approval of an NDA and commercialization. Aggregate payments made to date include the initial $50,000 upfront fee and an additional $79,232.53 to reimburse the licensor for past patent costs. Aggregate future milestone costs could reach $1,500,000 if the drug successfully completes Phase II and III clinical trials and is approved for sale and marketing by the US FDA. Future milestones on sales revenue are $1M on the first $20M in sales revenue, $2M in the first year cumulative sales revenue exceeds $100M, $10M in the first year cumulative sales revenue exceeds $500M, and $20M in the first year cumulative sales revenue exceeds $1B.

JHU – Mebendazole Prodrug License

On October 13, 2022, the Company entered into an exclusive, worldwide, royalty-bearing license from JHU and the Institute of Organic Chemistry and Biochemistry (IOCB) of the Czech Academy of Sciences for rights to commercialize N-substituted prodrugs of mebendazole that demonstrate improved solubility and bioavailability. The license covers prodrug compositions and use for treating disease as claimed in multiple US and worldwide patent applications. The term of the agreement began on October 13, 2022and continues until the date of expiration of the last to expire patent, or for 20 years from the effective date of the agreement if no patents issue. The license can be terminated by the Company upon 90 days’ written notice, or by the licensor in the event of any material breach of the license that is not cured by the Company within 30 days.

| 12 |

In consideration for the rights granted to the Company under the License Agreement JHU and IOCB will receive a staggered upfront license fee of $100,000. The Company will also reimburse JHU and IOCB for previously incurred patent costs totaling $33,265 and will be responsible for reimbursing licensors for future patent costs. Under the terms of the License Agreement, the licensors will be entitled to a four percent (4%) royalty on net sales subject to annual minimums upon first commercial sale of a licensed product, as well sublicense or assignment fees in the event the Company sublicenses or assigns their rights to use the technology. The Sublicense fee amount declines as the Company advances the clinical development of the licensed technology. The Company is required to pay minimum annual royalties (MAR) beginning in year 4 of the agreement. The MAR for year 4 will be $5,000, increasing to $10,000 in year 5, $20,000 in year 6, $30,000 in year 7, and $50,000 in year 8 and subsequent years. The Company will be responsible for milestone payments for patent issuance of up to $50,000 and clinical development milestones up to and including approval of an NDA totaling up to $2.3M. The Company will be required to pay a commercial milestone of $1M once sales reach $20M in the US, $2M when sales in the US reach $100M, $10M when US sales reach $500M, and $20M when US sales exceed $1B.

Competition

The pharmaceutical and biotechnology industries are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on proprietary products. The immuno-oncology, neuroscience, and rare disease segments of the industry in particular are highly competitive. While we believe that our technology, development experience and scientific knowledge provide competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical, and biotechnology companies, academic institutions and governmental agencies, and public and private research institutions.

Many of our competitors may have significantly greater financial resources, and expertise in research and development, manufacturing, preclinical studies, conducting clinical trials, obtaining regulatory approvals, and marketing approved medicines than we do. Mergers and acquisitions in the pharmaceutical, biotechnology, and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and in establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to or necessary for our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

The key competitive factors affecting the success of all of our product candidates, if approved, are likely to be their efficacy, safety, convenience, price, the effectiveness of companion diagnostics in guiding the use of related therapeutics, if any, the level of generic competition and the availability of reimbursement from government and other third-party payors.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize medicines that are safer, are more effective, have fewer or less severe side effects, are more convenient or are less expensive than any medicines we may develop. Our competitors also may obtain FDA or other regulatory approval for their medicines more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market. In addition, our ability to compete may be affected in many cases by insurers or other third-party payors seeking to encourage the use of generic medicines. There are many generic medicines currently on the market for certain of the indications that we are pursuing, and additional generics are expected to become available over the coming years. If our therapeutic product candidates are approved, we expect that they will be priced at a significant premium over competitive generic medicines.

Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future. If the product candidates of our priority programs are approved for the indications for which we are currently planning clinical trials, they will compete with the drugs discussed below and will likely compete with other drugs currently in development.

bfLEAP

The analytics industry and application of AI in healthcare is growing rapidly. Competition exists along the entire continuum of the drug development process from discovery to commercialization and beyond. We believe the weakness of the industry is the quality of the data and we believe bfLEAP provides several competitive advantages, that will position the Company for success, First, bfLEAP is highly scalable and can process data from small to extremely large complex data sets without the need for additional code being developed. Second, it is adept at processing and analyzing incomplete data and making predictions that we do not believe other technologies are capable of doing. Finally, bfLEAP has the ability to extract the most important features for analysis out of extremely large complex data sets using unsupervised machine learning algorithms, thereby greatly simplifying complex problems. Since data quality is a problem that exists in the healthcare industry, we see these as major differentiators. The ability to make predictions, find relationships and patterns and anomalies in extremely large complex data sets has been demonstrated by the Applied Physics Lab in other applications and sectors. Finally, the algorithms used by bfLEAP are proprietary and protected, having been developed at Johns Hopkins University Applied Physics Lab. We believe most of the competitors rely on open source algorithms and we also believe that we have already demonstrated our superiority via the August 2021 publication in DeepAI.org.

| 13 |

Government Regulation

The FDA does not currently require approval of AI technologies used to aid in therapeutics, but that could change in the future. The FDA will regulate any clinical trials conducted by the Company.

Our clinical development programs will, in some cases, require regulatory review of preclinical and/or clinical data by the FDA or other governing agencies, and subsequent compliance with applicable federal, state, local, and foreign statutes and regulations. The results of the clinical trials that we conduct will be evaluated by the FDA and other regulatory bodies. The comments and approvals that are obtained are expected to lead to milestone payments under the collaborative agreement. Accordingly, our ability to navigate the regulatory process is extremely important to the success of the Company. We believe that we have a competitive advantage in this process due to primarily focusing on drug candidates that already have some level of success in clinical trials. Previous success of a particular candidate in trials combined with our precision medicine approach to clinical trial design using our bfLEAP platform, will de-risk the development process and improve the chances for success.

Government Regulation and Product Approval

Government authorities in the United States, at the federal, state and local level, and in other countries and jurisdictions extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, post-approval monitoring and reporting, and import and export of pharmaceutical products. The processes for obtaining regulatory approvals in the United States and in foreign countries and jurisdictions, along with subsequent compliance with applicable statutes and regulations and other regulatory authorities, require the expenditure of substantial time and financial resources.

FDA Approval Process

In the United States, pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act (FD&C Act) and other federal and state statutes and regulations govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling and import and export of pharmaceutical products. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending new drug applications (NDAs), warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties and criminal prosecution.

Pharmaceutical product development for a new product or certain changes to an approved product in the U.S. typically involves preclinical laboratory and animal tests, the submission to FDA of an investigational new drug application (IND) which must become effective before clinical testing may commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

Preclinical tests include laboratory evaluation of product chemistry, formulation and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements, including good laboratory practices. The results of preclinical testing are submitted to FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls, and a proposed clinical trial protocol. Long-term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted. A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If FDA has neither commented on nor questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin. Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted: (i) in compliance with federal regulations; (ii) in compliance with good clinical practice, or GCP, an international standard meant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators and monitors; as well as (iii) under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to FDA as part of the IND.

| 14 |

Clinical trials to support NDAs for marketing approval are typically conducted in three sequential phases, but the phases may overlap. In Phase 1, the initial introduction of the drug into healthy human subjects or patients, the drug is tested to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses, and, if possible, early evidence of effectiveness. Phase 2 usually involves trials in a limited patient population to determine the effectiveness of the drug for a particular indication, dosage tolerance and optimum dosage, and to identify common adverse effects and safety risks. If a drug demonstrates evidence of effectiveness and an acceptable safety profile in Phase 2 evaluations, Phase 3 trials are undertaken to obtain the additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit FDA to evaluate the overall benefit-risk relationship of the drug and to provide adequate information for the labeling of the drug. In most cases, FDA requires two adequate and well-controlled Phase 3 clinical trials to demonstrate the efficacy of the drug. A single Phase 3 trial with other confirmatory evidence may be sufficient in rare instances, such as where the study is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible.

After completion of the required clinical testing, an NDA is prepared and submitted to FDA. FDA approval of the NDA is required before marketing of the product may begin in the U.S. The NDA must include the results of all preclinical, clinical and other testing and a compilation of data relating to the product’s pharmacology, chemistry, manufacture and controls. The cost of preparing and submitting an NDA is substantial. The submission of most NDAs is additionally subject to a substantial application user fee, and the applicant under an approved NDA is also subject to an annual program fee for each prescription product. These fees are typically increased annually. Sponsors of applications for drugs granted Orphan Drug Designation are exempt from these user fees.

FDA may also refer applications for novel drug products, or drug products that present difficult questions of safety or efficacy, to an outside advisory committee – typically a panel that includes clinicians and other experts – for review, evaluation and a recommendation as to whether the application should be approved. FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations.

Before approving an NDA, FDA will typically inspect one or more clinical sites to assure compliance with GCP. Additionally, FDA will inspect the facility or the facilities at which the drug is manufactured. FDA will not approve the product unless compliance with current good manufacturing practices (cGMPs) is satisfactory and the NDA contains data that provide substantial evidence that the drug is safe and effective in the indication studied.

Fast Track Designation

FDA is required to facilitate the development, and expedite the review, of drugs that are intended for the treatment of a serious or life-threatening disease or condition for which there is no effective treatment and which demonstrate the potential to address unmet medical needs for the condition. Under the Fast Track program, the sponsor of a new drug candidate may request that FDA designate the drug candidate for a specific indication as a Fast Track drug concurrent with, or after, the filing of the IND for the drug candidate. FDA must determine if the drug candidate qualifies for Fast Track Designation within 60 days of receipt of the sponsor’s request.

If a submission is granted Fast Track Designation, the sponsor may engage in more frequent interactions with FDA, and FDA may review sections of the NDA before the application is complete. This rolling review is available if the applicant provides, and FDA approves, a schedule for the submission of the remaining information and the applicant pays applicable user fees. However, FDA’s time period goal for reviewing an application does not begin until the last section of the NDA is submitted. While we may seek Fast Track Designation, there is no guarantee that we will be successful in obtaining any such designation. Even if we do obtain such designation, we may not experience a faster development process, review or approval compared to conventional FDA procedures. A Fast Track Designation does not ensure that the product candidate will receive marketing approval or that approval will be granted within any particular timeframe. Additionally, Fast Track Designation may be withdrawn by FDA if FDA believes that the designation is no longer supported by data emerging in the clinical trial process.

Post-Approval Requirements

Once an NDA is approved, a product will be subject to certain post-approval requirements. For instance, FDA closely regulates the post-approval marketing and promotion of drugs, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet. Drugs may be marketed only for the approved indications and in accordance with the provisions of the approved labeling.

Adverse event reporting and submission of periodic reports are required following FDA approval of an NDA. FDA also may require post-marketing testing, known as Phase 4 testing, REMS and surveillance to monitor the effects of an approved product, or FDA may place conditions on an approval that could restrict the distribution or use of the product. In addition, quality control, drug manufacture, packaging and labeling procedures must continue to conform to cGMPs after approval. Drug manufacturers and certain of their subcontractors are required to register their establishments with FDA and certain state agencies. Registration with FDA subjects entities to periodic unannounced inspections by FDA, during which the Agency inspects manufacturing facilities to assess compliance with cGMPs. Accordingly, manufacturers must continue to expend time, money and effort in the areas of production and quality-control to maintain compliance with cGMPs. Regulatory authorities may withdraw product approvals or request product recalls if a company fails to comply with regulatory standards, if it encounters problems following initial marketing, or if previously unrecognized problems are subsequently discovered.

| 15 |

Generic Competition

In seeking approval for a drug through an NDA, applicants are required to list with the FDA each patent whose claims cover the applicant’s product. Upon approval of a drug, each of the patents listed in the application for the drug is then published in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book. Drugs listed in the Orange Book can, in turn, be cited by potential generic competitors in support of approval of an abbreviated new drug application (ANDA). An ANDA provides for marketing of a drug product that has the same active ingredients in the same strengths and dosage form as the listed drug and has been shown through bioequivalence testing to be therapeutically equivalent to the listed drug. Other than the requirement for bioequivalence testing, ANDA applicants are not required to conduct, or submit results of, preclinical or clinical tests to prove the safety or effectiveness of their drug product. Drugs approved in this way are commonly referred to as “generic equivalents” to the listed drug and can often be substituted by pharmacists under prescriptions written for the original listed drug.

The ANDA applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Orange Book. Specifically, the applicant must certify that (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired but will expire on a particular date and approval is sought after patent expiration; or (iv) the listed patent is invalid or will not be infringed by the new product (a Paragraph IV certification). The ANDA applicant may also elect to submit a section viii statement certifying that its proposed ANDA label does not contain (or carve out) any language regarding the patented method-of-use rather than certify to a listed method-of-use patent. If the applicant does not challenge the listed patents or certifies that the listed patents will not be infringed by the new product, the ANDA application will not be approved until all the listed patents claiming the referenced product have expired. If the ANDA applicant has provided a Paragraph IV certification, the NDA and patent holders may then initiate a patent infringement lawsuit in response. The filing of a patent infringement lawsuit within 45 days of the receipt of a such certification automatically prevents the FDA from approving the ANDA until the earlier of 30 months, expiration of the patent, settlement of the lawsuit, or a decision in the infringement case that is favorable to the ANDA applicant.

Exclusivity

Upon NDA approval of a new chemical entity (NCE) that drug receives five years of marketing exclusivity during which FDA cannot receive any ANDA seeking approval of a generic version of that drug. An ANDA may be submitted one year before NCE exclusivity expires if a Paragraph IV certification is filed. If there is no listed patent in the Orange Book, there may not be a Paragraph IV certification, and, thus, no ANDA may be filed before the expiration of the exclusivity period. Certain changes to a drug, such as the addition of a new indication to the package insert, can be the subject of a three-year period of exclusivity if the application contains reports of new clinical investigations (other than bioavailability studies) conducted or sponsored by the sponsor that were essential to approval of the application. FDA cannot approve an ANDA for a generic drug that includes the change during the period of exclusivity.

Patent Term Extension

After NDA approval, owners of relevant drug patents may apply for up to a five-year patent extension. The allowable patent term extension is calculated as half of the drug’s testing phase (the time between IND application and NDA submission) and all of the review phase (the time between NDA submission and approval up to a maximum of five years). The time can be shortened if FDA determines that the applicant did not pursue approval with due diligence. The total patent term after the extension may not exceed 14 years, and only one patent can be extended. For patents that might expire during the application phase, the patent owner may request an interim patent extension. An interim patent extension increases the patent term by one year and may be renewed up to four times. For each interim patent extension granted, the post-approval patent extension is reduced by one year. The director of the United States Patent and Trademark Office must determine that approval of the drug covered by the patent for which a patent extension is being sought is likely. Interim patent extensions are not available for a drug for which an NDA has not been submitted.

Other Healthcare Laws

In the United States, biotechnology company activities are subject to regulation by various federal, state and local authorities in addition to the FDA, including but not limited to, the Centers for Medicare & Medicaid Services (CMS), other divisions of the U.S. Department of Health and Human Services (e.g., the Office of Inspector General and the Office for Civil Rights), the U.S. Department of Justice (DOJ) and individual U.S. Attorney offices within the DOJ, and state and local governments. For example, research, sales, marketing and scientific/educational grant programs have to comply with the anti-fraud and abuse provisions of the Social Security Act, the federal false claims laws, the privacy and security provisions of the Health Insurance Portability and Accountability Act (HIPAA) and similar state laws, each as amended, as applicable.

| 16 |

Also, many states have similar fraud and abuse statutes or regulations that apply to items and services reimbursed under Medicaid and other state programs, or, in several states, apply regardless of the payor.

Data privacy and security regulations by both the federal government and the states in which business is conducted may also be applicable. HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act, or HITECH, and its implementing regulations, imposes requirements relating to the privacy, security and transmission of individually identifiable health information. HIPAA requires covered entities to limit the use and disclosure of protected health information to specifically authorized situations and requires covered entities to implement security measures to protect health information that they maintain in electronic form. Among other things, HITECH made HIPAA’s security standards directly applicable to business associates, independent contractors or agents of covered entities that receive or obtain protected health information in connection with providing a service on behalf of a covered entity. HITECH also created four new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce the federal HIPAA laws and seek attorneys’ fees and costs associated with pursuing federal civil actions. In addition, state laws govern the privacy and security of health information in specified circumstances, many of which differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts.

Insurance Coverage and Reimbursement

Significant uncertainty exists as to the insurance coverage and reimbursement status of any products for which we may obtain regulatory approval. In the United States, sales of any product candidates for which regulatory approval for commercial sale is obtained will depend in part on the availability of coverage and adequate reimbursement from third-party payors. Third-party payors include government authorities and health programs in the United States such as Medicare and Medicaid, managed care providers, private health insurers and other organizations. These third-party payors are increasingly reducing reimbursements for medical products and services. The process for determining whether a payor will provide coverage for a drug product may be separate from the process for setting the reimbursement rate that the payor will pay for the drug product. Third-party payors may limit coverage to specific drug products on an approved list, or formulary, which might not include all of FDA-approved drugs for a particular indication. A payor’s decision to provide coverage for a drug product does not imply that an adequate reimbursement rate will be approved. Further, coverage and reimbursement for drug products can differ significantly from payor to payor. As a result, the coverage determination process is often a time-consuming and costly process that will require us to provide scientific and clinical support for the use of our products to each payor separately, with no assurance that coverage and adequate reimbursement will be applied consistently or obtained in the first instance.

Human Capital Resources

As of February 10, 2023, the Company has 4 full-time employees and consultants, including its Chief Executive Officer Vininder Singh and its Chief Financial Officer, Dane Saglio and 7 part-time employees, advisors, and consultants. None of these employees are covered by a collective bargaining agreement, and we believe our relationship with our employees is good. We also engage consultants on an as-needed basis to supplement existing staff.

Properties

Currently, the Company does not own any real property. All of the Company’s employees work virtually.

Legal Proceedings

The Company is not a party to any legal proceedings.

Corporate Information

BullFrog AI Holdings, Inc. was incorporated in the State of Nevada on February 18, 2020. Our principal business address is 325 Ellington Blvd, Unit 317, Gaithersburg, MD 20878. Our website address is www.bullfrogai.com. The references to our website in this annual report are inactive textual references only. The information on our website is neither incorporated by reference into this annual report nor intended to be used in connection with this annual report. All of our operations are currently conducted through BullFrog AI Holdings, Inc.

We file annual, quarterly, and current reports, proxy statements and other information with the U.S. Securities Exchange Commission (the “SEC”). These filings are available to the public on the Internet at the SEC’s website at http://www.sec.gov.

ITEM 1A. RISK FACTORS

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Smaller reporting companies are not required to provide the information required by this item.

ITEM 2. PROPERTIES

The Company’s principal business address is 325 Ellington Blvd, Unit 317, Gaithersburg, MD 20878, and the telephone number at such address is 408-663-5247. Currently, the Company does not own any real property. All of the Company’s employees work virtually.

ITEM 3. LEGAL PROCEEDINGS

We are not currently a party to any legal or administrative proceedings. Our current officers and directors have not been convicted in a criminal proceeding nor have they been permanently or temporarily enjoined, barred, suspended or otherwise limited from involvement in any type of business, securities or banking activities.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 17 |

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Information with Respect to our Common Stock and Tradeable Warrants

Our common stock is traded on the Nasdaq Capital Market, or Nasdaq, and began trading under the symbol “BFRG” on February 14, 2023. Our tradeable warrants are traded on Nasdaq and began trading under the symbol “BFRGW” on February 14, 2023.

Holders of Record

As of April 14, 2023 we had 19 shareholders of record of our common stock.

Dividend Policy

Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors.

Recent Sales of Unregistered Securities

None.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by this item with respect to securities authorized for issuance under equity compensation plans is set forth in Part III, Item 12 of this Annual Report on Form 10-K.

Issuer Purchases of Equity Securities

The Company did not repurchase any of its equity securities during the fourth quarter ended December 31, 2022.

Use of Proceeds from the Sale of Registered Securities

On February 13, 2023, our Registration Statement, as amended, and originally filed on Form S-1 (File No. 333-267951) was declared effective by the SEC for our initial public offering of 1,317,647 units, including 197,647 additional common stock, tradeable warrants and/or non-tradeable warrants, by the underwriters pursuant to the exercise of the over-allotment option, each at an offering price of $6.48 per share, $0.01 per tradeable warrant, and/or $0.01 per non-tradeable warrant, for aggregate gross proceeds of approximately $8.4 million. After deducting underwriting discounts and commissions and other estimated offering expenses incurred by us of approximately $1.1 million, the net proceeds from the offering were approximately $7.3 million. WallachBeth Capital LLC acted as sole book-running manager and the representative of the underwriters of the initial public offering. No offering costs were paid or are payable, directly, or indirectly, to our directors or officers, to persons owning 10% or more of any class of our equity securities, or to any of our affiliates. Our common stock and tradeable warrants are traded on Nasdaq under the symbols “BFRG” and “BFRGW”, respectively.

There has been no material change in the expected use of the net proceeds from our IPO as described in our final prospectus filed with the SEC on February 16, 2023. Upon receipt, the net proceeds from our IPO were held in cash, cash equivalents and short-term investments. As of March 31, 2023, we have used approximately $1.9 million of the net proceeds from the IPO, primarily on D&O Insurance, repayment of debt that was not converted in the IPO and accrued expenses for technology access, consultants and compensation as well as the costs for operations in the first quarter of 2023. Pending such uses, we plan to continue investing the unused proceeds from the IPO in fixed, non-speculative income instruments and money market funds.

ITEM 6. Reserved

Not applicable.

| 18 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

The following discussion and analysis of the results of operations and financial condition of Bullfrog AI Holdings, Inc. (“Bullfrog”) as of and for the years ended December 31, 2022 and 2021 should be read in conjunction with our consolidated financial statements and the notes to those consolidated financial statements that are included elsewhere in this Annual Report. References in this Management’s Discussion and Analysis of Financial Condition and Results of Operations to “us”, “we”, “our” and similar terms refer to the Company. This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains statements that are forward-looking. These statements are based on current expectations and assumptions that are subject to risk, uncertainties and other factors. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations. Actual results could differ materially because of the factors discussed in “Risk Factors” elsewhere in this Annual Report, and other factors that we may not know.

OVERVIEW